by Ashley

Guess what I just did!!!! I just mailed in the last payment for my Capital One (highest APR) credit card!!! Wahoo!!!!

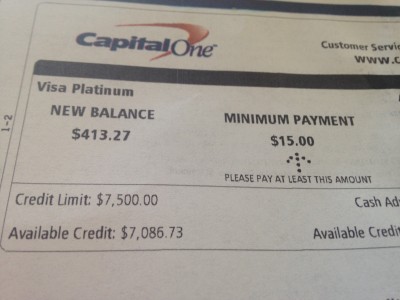

Notice that the credit limit is $7500. At one point, this card was maxed out and now, after mailing in that final $413.27, it’s down to ZERO!!!! Eeeeek!!!!

I could not be more elated! Now the plan is to snowball the payments I was making toward Capital One over to my next highest APR credit card (in this case, my Wells Fargo CC). It still has over $7500 in debt on it, so its not going to be a quick pay-off, but it’s at a 13.65% APR so its got to go!!!

Mwhahahahahah!!!! (<<evil genius debt-paying laugh)

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Early 40s, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

woohooo! Great job! I love the small wins, they really keep you motivated. Good luck on the next debt!

Very true! There’s nothing like the motivation – it’s almost like a debt-paying “high!” 🙂

Wonderful – what a great feeling!!!

I thought you were going to knock out the mattress loan next – two big payments of $600 and you’ll have that gone too…..then snowball all that money to Wells Fargo. Even though it’s interest rate is smaller, those types of consumer goods “No interest if you pay by??” loans are nasty – get rid of it quick!

Whatever you decide – congrats on your first win!

Do you plan to cancel this account now?

I don’t plan to cancel it, as I’m still concerned about my credit score. If I cancel then it will negatively affect the debt-to-credit ratio, as well as the average length of credit history. I haven’t used the card in a long time (it’s currently in a safe), so I plan to just keep it at a zero balance locked away so it won’t be used. In terms of the mattress loan, that is definitely next on the chopping block. So many people have commented on how shady these “no interest if you pay by X” type of companies are, and I certainly don’t want to be surprised by a huge interest fee. My calculations make me think its not due until Sept 1st (debatable – could be sometime in August because the statements don’t show a purchase date). My plan is to have it paid by June and then I know for sure I won’t be slapped with any penalties.

I think some Capital One card holders are charged a yearly fee. I’d close it. Dave Ramsey states that once they are paid, it’s better to close it. Paying in cash is the best way.

I don’t get an annual fee for this card. I do for my WF card, however. I know Ramsey suggests closing accounts but – for better or worse – I’m still very much in need of playing the FICO score game. At some point in the future we would love to buy a home, which will require credit. So in the meantime I’ll be playing the credit score game.

You are right about this… Credit/Debt Ratio they say take up 30% of your FICO score. Credit history also plays a good percentage… if this is your oldest card, it will most likely take a good ding on your score

Good job!!

Don’t cancel the account. Just keep it at zero. (By the way they may charge you a nominal amount of accrued interest for the current month, I don’t remember exactly how that works, but pay that off too and don’t use the card even if you are going to pay it off in full each month until you see a zero balance statement first).

Your credit utilization percentage will drop as a result of this payoff. And your average account age will continue to increase as long as the account is open. Both of those are good things for your credit score in the medium term. Canceling the card will do the opposite.

Why keep something open that is not going to be used? If they are going to charge an annual fee and then add interest, it’s better in the long run to close it. Why give them hard earned money and have nothing to show for it? The annual fee and the interest will show up on a credit report still.

Maybe I am just not getting the correct info, or else I have been listening to Dave Ramsey for too long. BTW, my credit is paid off and closed. I pay cash for everything (even my student loan, and mortgage).

Ashley is looking to buy a home someday so their credit will be important then. She should look into the annual fee situation.

Great accomplishment!!

Even a small win is a win! What a great way to keep yourself motivated 🙂 Keep it up!

I’m proud of you, Ashley! Keep up the good work!

Dan

Great job! I am sure you will knock out the others sooner than you planned.

That’s the plan! My official goal is one year (March 2015), but I would LOVE LOVE LOVE if I were able to get all the CCs paid off by the end of December 2014. Nice way to ring in the New Year, dontcha think? ; )

Congratulations! So proud of you and your accomplishments! 🙂

Congratulations- With over $600 going towards your credit cards each month you will really see some quick progress.

Congratulations!

Awesome!

Yay! Congratulations! Being able to pay that last bit off of something feels so dang good!