by Ashley

Our Financial Relationship

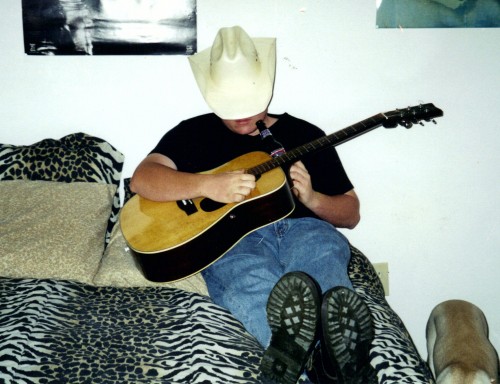

Chris and I met at the very beginning of my Freshman (his Sophomore) year of college – the end of August 2002.

Obviously we had some similarities, lol!

We started dating shortly thereafter.

By 2005, we were moving into our first (TINY and BARE) apartment together. Remember? This was from our pre-debt days!

From the beginning, I kind of took control of the financial aspect of our relationship. I am naturally drawn toward budgeting and saving and him….not so much. We made enough to survive just fine as long as I was in control, and I was even able to save up money so we were able to go on fancy vacations…

Dominican Republic, All-inclusive resort, Circa 2006

…and do lots of fun things, all while paying cash!

Floating the Guadalupe River one summer

But then we moved away so I could go to graduate school and, well, we all know how well that went (read: DEBT-CITY).

Fast-forward to present day.

My husband is the primary earner in our relationship right now. Unless I get a full time job sometime, it is likely to stay this way for awhile. However, he’s not great with money. So I am the primary money-spender in our relationship (in terms of budgeting, paying bills, etc.). The way we make this work is a little different than most people I know….

First, I don’t know exactly how much my husband makes. Don’t get me wrong – I’m involved in paying our taxes so I’m not completely out in the dark. But he has a variable income and on a week-to-week basis I don’t know exactly how much he has made.

How do we pay our bills?

Well, we have talked about and agreed on a budget so Chris always knows how much we need in order to survive and pay our debt obligations. If he’s having a particularly bad month (given that his income is variable), then he’ll give me as much as he possibly can – almost everything (post-tax) that he made. He does keep some money, but basically just enough to put gas in his work truck and have a little in his bank for business expenses (he does hard-wood floors, so he often has to buy supplies for a job prior to actually getting paid for the job).

On months that he does really well, he gives me above average of his “norm,” but I know he also keeps a little extra for himself. How much exactly? I don’t know.

I know many of my friends would hate this type of situation. They feel it is somehow dishonest or unfair for him to not share his exact earnings and give me every penny he makes so I can manage it.

But that would just never work for us. We have been together since 2002. There have been times in our relationship where I was the primary earner and, therefore, I was in control of almost all the money. It was a time of great stress and marital discord (well, we weren’t married yet, but you get the idea). Sure, we could pay off our debt a bit sooner if he were to give me 100% of his paycheck. But that would also, in a way, equate to castrating him (at least in his eyes). He can’t handle making all this money, giving it all to me, and then having to ask for some back and justify if he wants to buy fast food for lunch one day (as an example).

Writing this blog is a funny thing. I have already received SO MUCH great advice (thank you!!!). And, naturally, I go to my husband and talk about the things I have learned, as it impacts our family spending and budget. So in a way, “you” (the collective readers and commenters) have become a third person in our relationship. We discuss what you say, weigh the information, and try to make informed decisions as a result.

Prior to starting on this debt-reduction journey I discussed the potential ramifications with my husband. One think I thought you readers would push us on was revising this current financial situation. There are SO MANY different ways to handle finances. Why don’t we both get a small “allowance” or agree that he can keep “X” amount per week for blow money. But that number should be named, right?

Well, that’s great in theory, but it just hasn’t worked in real life.

And you know what????

I’m perfectly satisfied with our current financial relationship.

I know when he’s got a little extra money from a big job because he may show up with a new pair of shoes, but just as frequently he’ll use the money to spoil us by taking us out to eat, picking up a movie, or even running to the grocery store on his dime (rather than coming out of the budget).

I won’t argue that it might not be the best way to use our resources. If he gave me all his money, I would be able to allocate more toward debt each month and reach our goals sooner. But then my husband would be miserable. And you know the saying “happy wife, happy life”??? I think it equally well applies to husbands ; )

So I’m sure there will be many readers who will disagree with this type of relationship (like I said – I’m sure many of my own FRIENDS would disagree with it). But it works for us. And money remains one of the top reasons for divorce. So, as long as we are both comfortable and happy with our current relationship then I think that’s a really important factor. Even above the extra month or two that we could pay off debt early, had I been receiving 100% of his money. You can’t put a price on marital happiness.

Does anyone else have an interesting financial relationship? How do you and your partner handle finances?

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Early 40s, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

Ashley,

Thanks for tackling a difficult subject on the blog today–especially when you anticipate that many readers will disagree with you! I do agree that it would be “ideal” to have full disclosure about income so you could be the most efficient with your income and put the maximum amount toward debt. But I also hear you on how it’s important to do things that work for YOUR marriage and that there’s no price tag on marital harmony. A couple thoughts after your post:

1. It sounds like you are demonstrating a lot of trust in Chris in that you trust him to give you the money you need each month even when he gets paid more than expected, etc. I wonder if he is also matching your level of trust in the way you guys communicate about money? For instance, is he willing to tell you the exact amount even if that wouldn’t change how much you expect him to give you for the bills/debt? It’s not even so much that you HAVE to know how much he makes every month, but more the principle of the idea that if he’s not willing to trust you with that information, then that’s could point to some areas where he could learn to trust you more, and know that you won’t suddenly demand all the extra money he made etc. Honestly, he seems to have every reason to trust you in that you trust him, but I would just hope that’s a two way street on this issue (which it might be–I know you couldn’t include every bit of information relevant to the issue on one post….)

2. Is he willing to make sacrifices for this debt journey or does he leave those decisions up to you? Not saying at all that it’s unreasonable for him to keep money for gas, purchases for his business etc, but he seems to like to be able to surprise you guys with a gift or meal out with his share of the money (which is generous and great) but would he also be willing to say, “Hey, here is $50 extra toward debt this month because I have this left over!” etc. Not that this is absolutely a requirement, but I wonder if that would be a huge encouragement to you for him to join you in that way. Just a thought.

3. I also think it’s important for you to reiterate that you don’t respect him less just because you handle the money. I know he probably knows that and you’ve likely told him that before, but if you consistently tell him things that combat the belief that if he doesn’t control the money he isn’t a man (or whatever thought it is that makes him feel like less of a man) it could be a positive thing long term for y’alls relationship.

4. I think it’s great that you have a system that works for you and hope that any changes you make now or in the future make your communication and your financial situation even better!

~AY

Lots of good points. Here’s how I would respond…

1. I don’t think he would have a problem telling me the amount of money he keeps if I’m not demanding it. Honestly, I’ve just never asked (it hasn’t mattered to me as long as I’m getting the money I need).

2. Definitely. I should clarify then when he has “good” months, he may keep a little extra for himself, but he’s also giving me a lot extra too. That’s where most of our extra $2,000+ came from last month.

3. I don’t think he cares that I handle the budget and paying bills, etc. The problem would come into play if I had 100% of the money and he had to ask for “allowance” from me (particularly since its money HE has earned, as opposed to MY earnings). I know when we’ve had this type of relationship he had a really tough time with it. I think it basically makes him feel like a child having to “ask mommy for money.”

My questions are:

1. If he’s keeping money back to cover upfront business costs, isn’t that really just a business expense, not a “keeping money for himself” type thing?

2. Does he ever buy himself new shoes (or whatever) when his kids actually need something? Or, is this more of a now and then thing he does so his needs can come second to the overall budget? If he only buys things he needs, and does so this way to save room in the monthly budget for his family, then it sounds fine.

3. If there is enough for a serious payment on something, what about for his license fee? If I remember correctly, that one is due to a mistake on his part. If he has serious money left over, he should be mature and responsible enough to take care of his mistakes before buying himself stuff.

It really comes down to whether or not its enough of an issue to derail you all financially. I don’t see a problem with his not telling you, IF (IF IF IF) he would tell you if you asked. My work is also sporadic, and my husband is clueless about how much I make in any month. But, in our a case he could very easily find out if he wanted to know.

Hi Andrea!

1. Yes, you’re right these are really just business expenses. I guess the point I was trying to make is I know he keeps some extra for himself (aside from business purchases).

2.Absolutely not! He would never put himself and his wants above our family or our needs. In fact, sometimes he uses his extra money to spoil us and often in ways that I never would. One example is that he recently purchased our daughters new Nike shoes. I think the expense is absolutely ridiculous! They are babies and will grow out of their shoes in 6 months or less! I would NEVER EVER spend that much money on baby shoes (He got a sale, but still probably close to $60 for the 2 pairs of Nikes). If things are tight and/or we have familial needs, he would give me everything he has rather than spoil himself and leave us high & dry.

3.Good point! I’ll have to tell him about this idea (I can just imagine he’ll love it, lol) Honestly, though, I think the arrangement is more that he’d give me the extra money to allocate how I see fit. I think my credit card debt comes above his license debt because my credit cards have higher interest rates.

Regarding your answer to point #2, what would it make for you both to think that things are tight and you have familial needs? I would think the amount of debt (credit care, license and loans) you are carrying as a family have you already in the things are tight and you have familial needs camp. In the same vein I really think you are trying to justify living a lifestyle you can’t afford.

Certainly I agree that with the amount of debt we have, things are “tight” as they are. What I was trying to convey by saying “tight” was if we don’t have enough to cover our bills and make our debt payments for the month. With his variable income there are some really good months (typically his time of year, and into summer time) and there are leaner months (typically around the holidays, approx. Nov to January-ish). That’s part of the reason I’ve been reluctant to throw additional savings into debt, because I know the “lean” times pop up, too. During these times, husband would not be keeping extra money for himself – he would be giving me everything he has (minus money for his necessary business expenses). That’s what I was trying to say.

Back to another part of my question #2: Is he buying himself stuff that otherwise there is no budget for? For example, maybe normally there is no budget for him to buy clothes. So, when he does have a little extra, he spends it on necessities for himself?

Would he tell you how much he made each month if you asked? Would he keep track of the splurges a few months just to get an idea? Its not about control over him, its about the two of you, together, having control over your money versus it controlling you. 🙂

By the way – shoes is one area we never skimp on, especially with young kids. So, while he probably could have found a cheaper pair of Nikes for 2 girls, I’ve also always spent more for quality versus cheap shoes with no stability or support.

As conservative as I am, we ran our finances as a socialist cooperative. Everything we both made went into the bank account and we each drew an allowance so we could spend on what we want. It was then $30 a week and is only $60 now (20+ years later) because we really have no wants. Every other penny went to ‘house’ expenses – our budgeted expenses and savings (we only had a mortgage and one car loan over the years.) Dh’s salary covered the basics and my daycare income covered extras like piano lessons and the odd movie out and just reduced the strain of sticking to a strict budget.

The allowance gave each of us money we could spend without having the justify it to anyone. And it was an even amount because we both were contributing evenly to our partnership in the family.

In the past 5 years, my preaching training was all paid for by the ‘house’ and I’m slowly earning enough to cover those costs. That first paycheque with my name meant so much to me that dh said to deposit it into my own account but I pointed out that everything he had earned had gone to the joint account and so this should too, even though in one week of work I earn what he earns in an hour. We are not valued by our earning potential. Our worth is in the effort we put into our relationship and our working together to build (and now, enjoy) our life together.

I think if this works for you then so be it. I think that you want to give your husband financial space and that you really like having some fluff money outside of your budget.

I completely understand your husband’s point of view, because for many years my DH was away from home (truck driver) and we had separate finances. Every week I would have to ask him for cash for household bills or savings my income could not quite cover, and it felt kind of awful. DH never minded nor really cared, trusted that I needed it to keep our household running, but it made me feel weirdly defensive when he asked me about the amount or where it was going. Many times I was not planning to spend it, merely adding it to our emergency savings,

These days DH does not work outside the home and I am the family earner. It took a long time to get DH accustomed to using the credit card for gas and household project supplies while I was at work, so I got into the habit of ensuring there was at least $300 in the safe for him. I usually check every month or so and withdraw cash to get it back to this level. DH has no clue how much I make and does not mind at all. If he ever has a question about something financial he just asks me.

If this works for you and your family, go with it. My husband has always been the primary breadwinner. Every two weeks, he deposits money in my checking account that I use for groceries, gas for my car, and misc. I work part time as a substitute teacher and have a savings account in my own name from those earnings. However, I always keep my husband apprised of the status of that account. We have joint savings in which he makes deposits, and he keeps me apprised of those too. My husband also writes all the bills.

We began these separate checking accounts years ago because we sometimes ran into trouble when the left hand did not know what the right hand was doing! Unlike your husband, our income is not variable, and I know exactly what it is. Both of us are savers and not spenders, so if it is a large purchase, we always discuss it first. Whatever floats the boat is what I say! Thanks for sharing.

Ashley (and Chris),

First of all, you guys look great together!

I would echo some of the previous posters: if it’s working, then do it that way.

My wife and I have always been “pool it all together” folks, and that works for us. But I also know friends who have completely separate finances and it seems to work great for them. Yours seems like a hybrid, and the most important thing is that it works.

Two small pieces of advice:

1. $60 for baby shoes?!?! Yikes!

2. Please make sure that you guys keep the lines of communication open with respect to finances so that adjustments can be made as circumstances warrant! In other words, doing something because “we’ve always done it like that” is not good, make sure you are always doing the thing “because it works”. Not written very articulately here, but hopefully the meaning gets across.

Lastly, I am too lazy to write a separate comment back in the childcare thread; Ashley, please take advantage of your incredibly good current daycare situation and invest in your professional development. $600/month for TWO babies? No brainer! 🙂 (Coming from someone paying many multiples of that at the moment…)

: )

My husband and I set up a similar situation before we got married – we figured we would remove the #1 issue that couples argue about… We each keep our own checking accounts and have a shared account that we contribute to equally for household bills. I have debt that I’m working on while he has a lot saved..but it doesn’t seem ‘fair’ to ask him to pay my bills. I think this is fine if it works for you, however, it seems like it would be much more difficult with kids involved or if one partner makes more than the other

Just catching up now on all of today’s posts so I am just going to comment on all of them here. A lot of what I read doesn’t seem to align with your goal of paying off debt and since I do believe you are sincere, here are my thoughts.

1) Daycare-Take care of the kids at home and don’t do any daycare. You’ll save $600 a month or $7200 over the course of the year and that is a big number. Most working women would “love” to be able to stay home and take care of their kids and you have that and yet you need to change your thinking. Instead, what you talked about was more of a “convenience” in my opinion. It allows you to get more work done, it’s easier, etc, etc. Your husband likes the structure of daycare, knowing how many diapers were changed etc and the food that was eaten. These are kids. My son is 22 and “total care”; I don’t have any daycare and yes it’s hard getting things done. I make everything from scratch and have to blend it up. There is no fast food ever because he can’t eat by mouth. I track bowel movements on a calendar inside my cupboard with a simple hash tag or straight line. I don’t track wet diapers because honestly, I am changing them all day so I know if he hasn’t been going. If his lips get dry, he’s getting dehydrated. Simple enough. But it’s not about me and what I’d do. It’s about getting out of debt. You’d have to earn $10,000 to net $7000 on average so you can do the math. That’s a $10,000 savings by watching the kids at home. What I might suggest is that while you are getting out of debt, that you put daycare on the back burner for one year. Instead of saying you’ll do this forever, commit to skip daycare for one year and then revisit the topic in one year. That way, it gives you some control but yet you get your debt paid down. I do that a lot when I am trying to reach a financial goal. I put it on the burner for one year or 6 months or whatever and then I can revisit it them. It makes it easier. Our parents didn’t have daycare, etc and really, what you have mentioned is really more of a “convenience” issue…having daycare is “convenient” since it’s easier to get things done, you don’t have a family member to care for them, etc. I am not saying that it’s not o.k. to feel that way, I am just saying that if you are serious about paying down debt, I wouldn’t do it.

2) It’s wonderful you made your own baby wipes. I think that is great and it’s a real cost savings. I know because my son is 22 years old and I go through one three pack (80 count each) a day. The second part of that post talked about a “30 day want list”. The 30 day want list is great if you are out of debt. It’s a “want” and not a “need”. All of those items you thought about were “nice to have” but none were really necessary. I think you need to ask yourself if getting those items are more important than getting out of debt. Add a dollar figure to each item and add them all up. That’s money that is taken away from paying down debt. It’s great that you waited on some things, but really, these things are wants and not needs. At this stage, I think you should only put things on a 30 day list that you need and only purchase the “need” items if you are desperate. It never hurts to want something or delay our purchases however at this stage of debt, the “want” items shouldn’t even be a topic of conversation.

3) Not knowing what your husband earns. This is crazy. Now hear me out. I don’t have an issue with your husband wanting or needing money or needing money for supplies but you both should be on the same financial page and that means knowing the exact amount that is coming in and the exact amount going out. How can you manage anything in life if you can’t measure it? You can’t. You need to know how much he spends a month in supplies. You’ll be better prepared for the ups and downs in your budget if you have some clue as to what the supplies cost/month or what the supplies cost in a good or bad month. You have to know. As for his spending money, you keep track of what he keeps on hand and then you can put that in the budget. As time goes on, if he’s spending it on fast food, you can make a choice to make all lunches for him, some lunches for him or no lunches for him but you’ll know what that number is and you’ll make an informed and joint decision. That won’t make your marriage weaker or make him less of a man, it will make your marriage stronger in that you are working for a common goal. Getting debt under control will make it easier on him so he won’t have to work so hard for his family. That is a gift and not something that you are taking away from him. It’s all about looking at this from a different perspective. I don’t doubt for a minute that he’s working hard for your family or that he’s doing the right thing, but you have to know. You are both adults. In the end, anything you agree on is o.k. however if you want to get out of debt, you have to know “all” of the expenses, not “some” of the expenses.

I just got the feeling when I read your posts that you were acting more out of routine instead of stepping back and taking a good look at everything. Daycare is definitely a “want” at this point and I think you need to really evaluate that more clearly. With my son, I do understand how difficult it can be….I was up at 3 am, 4:15 am 5am, 545 am 615 am 618 am and it’s tiring. I get so tired sometimes, I’d love to hire someone so I could take a nap. I have a lot of medical paperwork to do so often I do it from 3 to 6 a.m. while he’s sleeping. I give meds every six hours so there isn’t much time for slacking. It’s not to compare but really just to put things in perspective. You have it pretty easy and they won’t be two forever. You can take the kids to the park when it’s nice and even if you don’t know anyone, if you go there enough, you’ll see the same people The kids will play together and they’ll have all of the socialization they need. One last comment is to get Kevin O’Leary’s book titled, “The Cold Hard Truth about Kids, Family and Money” or something like that. He was on a talk show recently and he addressed the issue of one parent staying home with their kids. He said that one parent needs to take care of the kids at home and you can’t have a nanny or daycare or whatever. He says it’s because you need to teach your children your values and that isn’t something they should learn from anyone else. He also talked about how to instill the value of money with your kids. I think it would be a good read based on your situation. Good luck.

Mary, I think you are right about all of these points! I don’t think a lot of people know what it really takes to get out of debt. It’s not just reducing the grocery bill a little. It is a huge shift in lifestyle and thinking. I think that any kind of daycare expense at this point is just crazy! I have four children, and when they were young, I helped out with our family finances by doing data entry at home. We did not rely on daycare. I worked from about 8-12 PM every evening and also fit in hours on the weekend when my husband could watch the children.

I read some of Ashley’s comments and realize that she wants a break from the girls and motherhood. Yes, it is time consuming (and I certainly see that in your situation, Mary). Is she being honest with herself that she is accomplishing a lot work wise while the girls are in daycare? And yes, the financial books need to open at any house. I believe that Ashley and her husband need to jump start this debt repayment with a good hard look

at their lifestyle choices. That kind of debt would give me heart palpitations!

Hi Ashley and Chris,

I wanted to tell you I think you’re doing just fine.

Do what works best for you and your family.

Do what keeps both of you happy.

I think you’re both aware that with your current strategy you won’t pay off debt as soon as you’d be paying it off if you were attacking it like the guy from No More Harvard Debt.

I think that’s fine though.

I would try to scale back on the spoiling-part though until you’re out of debt.

I find these posts so interesting. I’m not married but I’ve always been curious about how couples handle finances. Thanks for going into detail. I’d actually be curious about how the other married bloggers handle it as well. Gives me things to think about for when I do get married.

One thing i know though is that marriage, just like all relationships is not one-size fits all. So take all advice like you should relationship advice – with a spoon of salt. There’s a saying where i’m from – “it’s the person that’s wearing the shoe that knows were it hurts”. If it works for you, it works for you.

To me it doesn’t sound like there are any real problem areas. I think as long as you keep him involved with the debt tracking so that he knows how the extra payments and such help then that’s good enough This might be old-fashioned but i know as a guy – having a target of how much he needs to bring in to take care of his family is something they respond well too.

Anyway, I definitely like you the best as a blogger. On the child-care note, i think those saying cut out day-care haven’t been around toddlers – much less twins – in a while. I would 2nd the idea that someone had of having someone come to your house to entertain the kids – middle schooler or junior high/high school. You’d be available if anything major came up and it would probably be cheaper.

Good luck with everything!

I also find these posts interesting because for me, my partner gives me all of his income because we need every bit to cover our bills and it’s just easier when everything is going through one person for us.

I know it’s not fair for him to pay my debt bills but i need all the help i can get right now and we are both in this life together forever til death so it’s almost like he’s helping me pay our debt off, right? right? right? Lol

I think this is an incredibly personal decision. In my eyes, when we were married were were joined as one. My debt is his debt and his debt is my debt. We’re in it together. At the same time, I also feel a bit more burden because the majority of our debt is mine. And, from a realists’ perspective, the divorce rate still hoovers around 50%, so there’s that factor. Ultimately, I think it comes down to what works for YOU in YOUR relationship. I love to hear input from others and am absolutely fascinated by how others handle finances in a relationship. I think there’s a lot to learn. But at the same time, if you find something that works for you then I say to stick with it.

Wow what a good string! I have been following this blog for a few years now. When I found it I was married and wanting to pay off all of our debt. My husband at the time was more interested in filing bankruptcy. I told him we got in to this mess and we can get ourselves out. I paid all the bills but disclosed everything to my husband. We knew what each other made. The problem in our relationship was I wanted to pay debt down badly and he kept buying “wants” on a credit card. I also made more than my husband. Although he would tell me he was on board it never came to fruition. The result, I became resentful and he cheated and walked out [at the same time my father was dying of cancer]. I have had to file bankruptcy, I am losing my house and my divorce is STILL not final.

The only debt I do have is a car loan and a rather hefty amount of $17K I owe my mother. This was a low interest loan to my ex-husband and I to pay off debt [originally $25k which we paid down to $16K but I have had to put payments on hold due to filing for bankruptcy, getting a divorce, etc.]. My ex-husband refused to work things out financially even though divorce was inevitable and I could not handle all the debt on my own. The money I owe my mother my ex will never pay a dime of and it will take me 6 years [hopefully less] to pay her off. My siblings know I owe her money and in the event she passes before I can pay it off it comes out of my inheritance. I would prefer to pay it off.

The interesting thing about the aftermath of this situation is I don’t feel completely stable yet, I hate that my only option was filing bankruptcy. I didn’t feel relieved when it was over like my attorney said I would. My car loan is not through a bank but to a friend who wanted to help me out since after bankruptcy any car loan I do get would be high interest.

I have started my own home business through a great company [if anyone is interested they can message me privately] on top of working 40+ hours per week so the extra I earn can go to first beef up savings and then snowball to my mother.

The bottom line is I really admire those of you who are paying things off without the route I had to go through. I learn things by reading this blog and I am vowing to never be held hostage by my situation ever again. I love that I am the only person who has control of my money. I have savings for the first time in a very long time. Suffice it to say, I am happier than I have ever been. I am in a relationship with a wonderful person and I do not plan to ever combine finances again. The only way that would happen would be a joint account for common household bills. I am 42 and “starting over” so to speak. I worry about retirement and eventually purchasing a home in the future but that will all come with time.

I’m sorry I made this post all about me, I guess I wanted to share my story because it can be a learning tool as well. I may or may not share this part on my current blog or a new one but wanted to share it here.

I appreciate hearing your story! I hope the best for you in rebuilding your life and moving forward in your new relationship!

Speaking as someone who just got cleaned out in a divorce — and by cleaned out I mean I lost my house, half of my retirement savings and pretty much every personal possession I ever purchased — I can’t support this way of handling finances.

I trusted that my ex-husband was saving for retirement and we kept separate accounts for a 10-year marriage. We held a single joint account for paying bills only. When tax time came, I signed the forms like a good girl and went on my way.

Fast-forward to sitting at an accountant’s office, dumbfounded, finding out he had $25k in credit card debt and had saved NOTHING for retirement in 10 years of marriage. And to help “even out” the inequity in our assets (!), I would have to vacate the marital home and surrender every dime I’d ever put into it, including tens of thousands into landscaping and furnishings.

I beg you to share this information with each other and stay informed every step of the way. I blame my ex-husband for a lot of my current financial strife but it was my mistake too. I trusted him to be an adult and look out for our family and look what happened to me.

i think the key is always, even if one person handles the finance

1. the other person should be able to logon and see what’s going on at any time.

2. the other person should have regular discussions about what’s going on with their money (even if it’s high level).

I think it’s when it’s clouded in secrecy that problems arise.

What a terrible situation! My heart goes out to you! As an update about not knowing what my husband makes on a week-to-week basis… we talked about it and he said he is fine letting me know as long as he is still able to have some money of his own. Me not knowing was mostly due to the fact that I just don’t ask (as long as I was getting the money we needed, I was fine not knowing). I think things are also muddied by the fact that sometimes the lines blur between “his” money and the business money (needed for business expenses, payroll, etc.) Admittedly, his small business has been a work-in-progress (about 4 years old at this point), started from scratch, and we really didn’t know what we were doing when we first got into it. Perhaps this would be an interesting topic for a future post.

Transparency is a good thing and especially if he has his own business, it’s good to keep business and family money separate for tax purposes. 🙂

Somehow I have a feeling this cannot be good for a marriage. It’s not about the money, but the wife not even knowing how much the husband makes seems a little off putting to me. It would be different if both spouses were working – I know a lot of couples who have separate accounts for their paychecks. The way it looks right now is – you are ok with getting money from him, but he is not ok with you giving him money? Of course this is my personal opinion, but if my husband were this way I would be worried. If I were you, I would want to fix this right away with some marriage counseling or therapy. Sure things seem fine now, but you both are young enough that there could be some trouble down the road. You need to make sure you and your kids are protected

Ashley thank you. The man I am in a relationship with is very open about finances and also does not want to combine which [as I mentioned above] I am fine with. We have been discussing me moving in with him. He has a house that will be paid off in 12 years and we have been going over the ramifications of what that means for me and our future together. It’s beneficial for both for our finances as well as our future retirement plans. We are in committed to a long term relationship. I do plan to buy a home even if I never live in it but rent it for my own security/retirement.

I beg all of you who are young(ish) and just starting out to just please stay informed. Don’t let things be hidden from you. Don’t not ask. Don’t just sign those tax forms and leave them — LOOK and READ and know where the money is going.

Now in my 40s, there’s so much I would have done differently. I consider myself to be a very smart person and I cannot believe I’m starting over financially in my 40s. I had been on track to retire at age 50, and it’s all been wiped away in one fell swoop. Decades of compounded interest gone, poof, obliterated. It’s not always happily ever after for everyone.

Oh, if I had only had a Dave Ramsey around when I was in my 20s! I wouldn’t be sitting here trying not to think about working until I’m 65. Or my decimated retirement accounts. Or the fact that I’ll be paying PMI on my mortgage for the next 5 years at least while my ex-husband enjoys the home and things I broke my back for. Praying my paid-off, 8-y-o car will hold out another few months or maybe a year or more just to let me breathe. Hoping that nothing major in my house breaks or goes to crap. Fully expecting there to be no social security when I retire, even though I’ve now been paying into it for 20 damn years.

Don’t misunderstand me. I’m not a pessimistic person. But life circumstances can change in an instant. Please, please insist on total transparency with regard to finances. It can only help you.

When you’re self employed you don’t always know what you’re making each week/month. My husband and I have had our own company for almost 25 years. We went through slow times where money was tight but knew we had to pay ourselves a certain amount each month to cover the bills. As a business owner your husband needs to keep a certain amount of money in his business account to keep him running from month to month BUT he also needs to know what minimum amount of money he needs to pay himself (and you) each month to cover the home expenses. One thing that pops out at me is that only business expenses come out of our business account. This doesn’t include personal items like shoes for the baby. If you & your husband want to budget “blow money” in your personal/house budget that’s fine but it seems like the business account is considered your husband’s “blow money” account.

I like to say that my husband and I have separate accounts, but joint finances. Day to day, we each manage our own income and spending and such. We each have our own checking, savings, investment accounts, etc. It’s just simpler that way. However, we also combine forces and work together to accomplish our goals. We back each other up if needed and handle problems together. We also have complete financial transparency with all accounts and purchases.

I get a lot of flak on PF blogs for having “separate finances”, as if the lack of joint checking means my marriage is meaningless. (Seriously?) It’s nice to see people here being open to different styles and more concerned with the perceived imbalance in your situation. The mechanics of money management aren’t nearly as important as working together and operating as a team. That’s the important part! If your husband’s splurges are in line with your budget and available resources and take into consideration your debt position, then it’s all good. If not, it bears discussing, awkward as it may be.

Personally, so take what you like and ignore the rest – I’d separate the business expenses into its own account. Get him a personal checking account for his spending money. Then I’d set up some solid formulas for handling the money. For example, the business keeps a buffer of $X for expenses/supplies, $X is set aside in savings for lean months, he gets X% of profit for personal spending and the rest goes to the household budget. Increase the percentage when the debt is paid off. That puts an agreed upon cap on personal spending, clarifies the business expenses, and leaves him his own money and motivation to make more money and pay off the debt. But like I said, personal opinion of what would work for me. YMMV

Thanks for the comment! I definitely agree his business and personal accounts should be separated. This is still a new “issue” for us (albeit a good one to have!) because until very recently he was barely making enough to cover our basic expenses, and giving me basically everything he was making. Only in very recent months has his income started to increase (which is due to the fact that he’s taken on an additional crew so he has additional jobs and additional income coming in). It wasn’t as big of a deal when there was nothing leftover but now that there IS some $$ leftover it definitely needs to be separated into “business” “his” and “ours”