by Ashley

It’s such a happy day for me today, friends!

After many months of slowly chipping away at larger debts (last one paid off was in April 2015, but whose counting?) am able to finally announce that I’ve paid one (albeit small one) off in full!

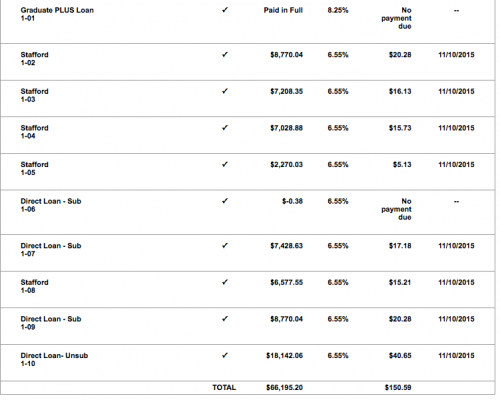

TODAY, I am cleared of Navient loan 1-06.

The first time I ever broke apart my Navient loans for you was back in March 2015. At that time, loan 1-06 was sitting at $860.80. For months now (really the whole time I’ve been blogging), I’ve only been paying minimums to this account which has only paid the interest (no reduction in principal). I paid a little extra on my unsubsidized federal student loan (which is not even listed in my Pandora’s Box spreadsheet – that spreadsheet only accounts for my Department of Education loans).

But then I’ve been having some SERIOUS drama with Navient. (mini-update: there is no update. I was contacted by the mediation specialist who gathered some information and said it would likely be a full month before I hear back again. My loan that was transferred from ACS is still incorrectly classified as an unsubsidized loan and continues to accumulate interest when, due to my IBR status, the interest should be forgiven).

ANYWHO…..all the drama and frustration with Navient just makes me want them out of my life that much sooner! So I decided to also start chipping away at loan 1-06, as its my smallest loan (even though it is also a subsidized loan; I felt the small balance made it a good candidate to knock out quickly). So over the past few months I’ve put an extra $100 here and there toward it. Nothing huge. But then this month I logged into my account and saw the balance due was less than $500. And I just decided – I need this. Let’s go for it!

I talked to hubs (this required re-allocating some of our money a little bit differently than what we’d originally planned), and he was on board so I made the call and paid off the loan in full.

Logging in today I am THRILLED to see that big “No Payment Due” next to loan 1-06.

I cannot wait until they all read that way!

Just as a reminder, I’m seriously on a mission now to pay off our car. It’s our last remaining consumer debt and my goal had been to have it paid in full by December. In this previous post I admitted defeat on that goal and settled for having it paid as early in 2016 as possible. Well, friends, I take that back again. It’s going to be tough. TOUGH! And we’re planning to travel in December, which makes it twice as tough (since hubs isn’t salaried he only gets paid when he works, plus we’ll be incurring travel costs, etc.). But I’m on a mission. It’s like back when I first started blogging and I was hell-bent on paying off my credit cards. I managed to pay off over $10,000 in credit card debt in three months! I still can’t believe that was me! It’s not like we were rolling in dough and had nothing better to do with it. That came about from a lot of hard work, careful budgeting, sacrifice, extra hours, etc. etc. etc. I’m on the same mission now. We have about $10,000 left on the car. 3 months worth of debt payments between now and the end of the year. Is it likely? Probably not. Is it possible? Maybe. Just maybe. I plan to give it a hell of a shot. I’ll let you know. ; )

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Early 40s, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

Thank you for mentioning your Navient issue. It had slipped my mind, that a month or so ago, I called my loan service about a wonky loan of mine. Original balance of $1,400. Unpaid Interest of $915.76. Current Balance of $3.270.00. Something is broken with this one. I never heard back. So I guess having an unexpected day off today is going to come in handy!

Oh no! I hope you’re able to resolve the issue with more luck than I’ve been having!

I am rooting for you on paying off your car debt–mainly because our only debt now apart from mortgage is on our Honda Pilot, bought new for $31,000 with $12,000 trade-in in January 2013, up until then we had never even considered car loans as debt–just a part of life. But we had worked on paying off successfully all other accounts before Husband’s retirement in 2012, plus building an emergency account of $15,000, re-roofing and painting the house and replacing all sorts of interior items + two entirely new bathrooms.

Now we are down to $3,400 on The Honda and intend pay-off with December’s check. It’s been a bit difficult some months but we have pulled in our belts.

Retirement has been such a blessed relief–my husband went to 69 years old, and our combined Pension + social securities is $5,600 monthly and with a monthly mortgage payment of $922 we are really comfortable–never thought we would reach this haven after all sorts of setbacks including Hurricane Floyd which wiped out all of our ground floor possessions (We learnt the value of Goodwill and Salvation Army thrift stores at this time) Plus we no longer help out with grandchildren’s private school fees–a necessity in the rural Texas county where they live.

We were both academics on never more than relatively modest salaries, but a satisfying work life. So hang in there Ashley and try not to slip back any month–this can be so discouraging. You are doing so well.

Thank you! It’s fun to hear reader’s stories of how getting out of debt has changed their whole financial future! Good luck to you with paying off the remainder of your car, too!

Congratulations! That’s awesome! After you’re car loan is done I am excited to watch you guys really hit your student loans. I have a feeling your issues with Navient will add fuel to your debt burning fire 😉

It certainly does! It already has! I just hate them so much, I cannot wait until they’re out of my life forever!

I love your passion! You CAN do it!!!! Good luck- paying off your car is the BEST feeling. I only have a tiny bit on my last student loan $2,996, but I am not feeling super motivated. I could probably pay it off by the end of the year, but we just got a crazy big dental bill that has dampened my spirits. You have inspired me to look at my budget and work a little harder. Thank you and good luck!

Oh my gosh, that’s so close to the end! Don’t let up now!!! (also, I empathize with the giant dental bill. ugh!)

Ashley,

[lame joke alert] how about you dress the twins up as Navient for Halloween? Wouldn’t that be the scariest thing ever?

Good luck with the further pay-off!

Ick! Scary, indeed! Although, I think a problem arises here in that I don’t just fear Navient (and what new mistakes they’ll make), but I passionately HATE them. I cannot dress my sweet, innocent children in the garb of a company I so vehemently hate. ; )

Way to go, Ashley! This is awesome!!!

Thanks!

Nice job! You’ve had so many downers lately that I’m glad you went ahead and cleared a debt. It must really help your state of mind.

Thank you! It’s certainly helped!!!

But Ashley,

As I read what you posted, while Loan 1-06 does say “No Payment Due,” it does NOT say “Paid in Full!”

In fact, it shows that you still owe 38 cents!!

You might want to make sure that the folks at Navient consider that particular loan to be “Paid in Full.” I’d hate to see you have problems over a stinkin’ little 38 cents!!

Janell B.

It’s actually a negative 38 cents. As in, they over-charged me. Not surprised. They can keep the 38 cents (or, more likely, will simply apply it to the rest of my loans). I called in to make the payment over the phone and paid the exact (to the penny) amount that the customer service rep said was owed. Really not surprised that she was wrong. But, no, I do not owe any money on that loan.

Just wait until it is says “Paid in Full” and then you’ll feel really satisfied! I recently paid off one of my tiny Navient loans and about a month later it said “Paid in Full.” Makes me happy every time I see it. Now to just make the other loans say the same….

This happened to my husband years ago. Shortly after we met he received a registered letter from the University of Texas: His MA graduation parchment was being withheld because his college loan payment was overdue–he owed 2 dollars and 10 cents, some of this interest. He had thought it was paid off. The postsge to send this to him was more than the minuscule amount being demanded.

That’s awesome! I literally just broke a part my Navient loans today. It’s an interesting way of looking at them since I’ve forever just seen them as two separate payments – one a consolidated loan and one a federal loan. But now the federal loan is actually 5 separate, smaller (manageable?) loans. I can’t wait until my loans are finally paid off! I’m 10 years out of college and still feel like I have forever ahead of me to pay 🙂

You can do it!!! Getting started is the hardest part! : )

Ah!

That little negative sign appeared so tiny on my screen that I didn’t even see it!

It won’t take you long to get rid of that Stafford Loan 1-05 once you’ve paid off your car loan.

Congratulations for paying off that Navient debt!

Thank you! Yes, Stafford loan 1-05 is the next on my radar after my car is paid off. Also, you may recall I did a balance transfer to pay off one of my high-interest rate loans (1-01, which is why it’s listed as paid, but I really owe money on it still because I just transferred it to a no-interest credit card). That should be paid off by April 2016 and I plan to do another balance transfer at that time of one of my medium-sized balance loans (one of the ones in the $7,000-ish range). I haven’t decided for sure yet until we get to that point, but I’ll for sure transfer one of the other unsubsidized loans so I can save that interest and get it off Navient’s books (since they are absolutely incompetent!)

Hey Ashley,

Congratulations on paying down the debt! Way to work at it and not give up.

Keep it up!