by Ashley

Just to piggyback on my earlier post….

What do you guys think about this?

Image from this article.

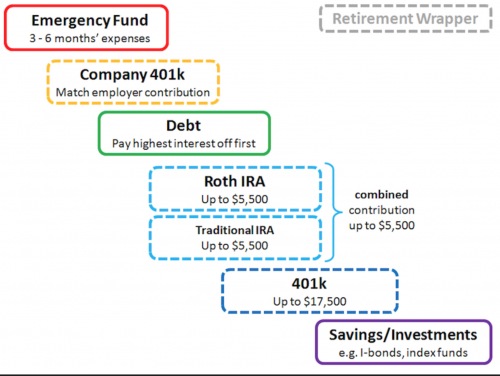

Apparently the image was originally from a poster on Reddit, who advocated a minimum 3-6 months of savings in an EF as well as a steady 401(k) contribution (up to employer match) prior to tackling debt.

It seems to me based on some recent conversations (occurring inside the comments sections of a few posts), that this is the approach advocated by some of our readers.

Of course, for any Ramsey followers (who, admittedly, is one of the first people to get me into personal finance, although I don’t blindly follow all his teachings; I pick and choose what works for me), this is drastically different than what is recommended. Ramsey’s Baby Steps advocate (#1) starting with a $1,000 beginner emergency fund. His argument is that most unexpected emergencies are about $1,000 or less, so that should be an adequate fund for most people. In my own debt-reduction experience, we’ve had a handful of emergencies (e.g., emergency root canal, emergency car repairs). All of our emergencies except one have been under $1,000. And the one time we had to raid our EF for over $1,000 was this past August. It was not actually due to any large emergency expense, but due to a lack of income! I don’t get paid in August (just due to normal schedule of payment) and hubs ended up having a no-income month that month (he has a variable income). So, really, I would consider this more of a factor related to variable income rather than due to an emergency, per se.

Ramsey’s next baby step (#2) is to pay off all debt but a mortgage, followed by (#3) going back and re-stocking the EF up to 3-6 months expense.

Obviously a very different approach, right?

What other factors do you think are important?

I think for single people, people without kids, people with low monthly expenses, renters, and people with steady/predictable income a lower EF might be sufficient. I also think it depends on the size of the debt (e.g., will it take 3 months to pay off or 3 years to pay off? I’m more likely to be “ok” with a smaller EF for a short period of time rather than a long one).

I’ve also seen some arguments over what debt should be considered high versus low priority. Some people are okay with student loans and car loans hanging around for awhile, though almost everyone is in agreement that credit card debt should be tackled quickly! I’m of the mind that I want ALL my debt gone. That being said, I’ve still prioritized my debt such that I have paid/plan to pay: (1) credit cards, (2) car, (3) student loans (4) medical bills. To me, our medical debt that has no interest is way less burdensome than my student loans (mostly at 6.5% interest), even though the overall amount of the student loan debt is significantly larger than the medical debt.

Those are just my thoughts.

How have you prioritized debt repayment savings? And, among your various forms of debt, how have you ordered or prioritized which debt to pay first? Do you do the snowball method (smallest debt first), avalanche method (highest interest first), or some other arrangement (such as the most personally satisfying)?

Personal finance is just that – personal. So I don’t think there’s one “right” or “wrong” answer and I think there are multiple different routes to the same end-goal (being DEBT FREE with a good financial security net). Just curious about your thoughts on the matter!

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Early 40s, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

I have no idea what I’m looking at with all those pretty colors…but I can say that I saved $10k in liquid cash (my EF) before I annihilated my car loan.

This chart is pretty much how I would (and do) approach things!

We got that first box up to about 18 months and my sleep has never been better…

Wow, that’s awesome! I bet its a great sense of security!

My order was 401k match, Roth IRA, debt, lots of catchup spending after getting out of debt, then emergency fund. I now split cash between 401k, Roth IRA and taxable investments.

I feel comfortable having a $1500 emergency fund , $1000 rainy day fund and $500 checking account buffer while tackling my highest interest rate debt first which is a credit card that sits right below 15%. I have debated depleting at least my rainy day fund and fun money fund to bring down my credit card debt but i’m so fearful some emergency is going to happen if I do. I plan to keep on this path (which will have me debt free…minus a federal student loan that will be forgiven) for now. Once I get closer to my estimated final payoff date for my credit card, I will probably just deplete the rainy day fund and build it back up later. I’m satisfied with my current savings for now while tackle all my debt. Plus I am contributing to my pension and putting a small amount in my 401k (no match) every paycheck.

Ouch! My highest interest card was a 13.9% APR. No fun! Good luck wiping it out! I like the idea of having the rainy day fund for now, and then when you get down to the final payoff date just wiping out the card (using that cash if necessary) and building it back up. It will go quickly once you’re not worrying about debt payments anymore!

It may make more sense to contribute to an IRA before paying off some debt if one is eligible for the savers credit.

Not only that, but I’ve also seen people advocate for using a Roth as an EF. I like the idea of keeping them separate, but the idea is that you can withdraw from a Roth (up to the amount put in, not interest earned) penalty-free, so some people prefer to use it as an EF.

I follow the above. Except my emergency fund is around 2 months. I do think it is missing one important piece. Maxing out your HSA! Starting an HSA when you are healthy is a great idea. Money can be invested in ETF’s and continue to grow while you don’t need it. If an unexpected medical condition arises you will be so happy when you don’t have to worry about paying the bills or skipping tests because of money! HSA contributions skip FICA, federal, and state taxes for the most part too. So really its not taking that much out of your paycheck. Everyone who has migrated to an HDHP should max it out and think of it as the added cost of a lower monthly premium.

Roth as an emergency fund is tricky. I would advocate it as a secondary emergency fund. Say you have a few months expenses readily available but Roth available only in extreme or catastrophic situations. One thing to note, you can pull Roth contributions and re-contribute within the same year to have no penalty.

3-6 months emergency expenses is a great idea but I think that would immediately overwhelm someone like my husband. He would throw his hands in the air and give up before he started.

Now that – I can relate too! But after my current situation maybe I’ll be more motivated on the EF front.

How have you prioritized debt repayment savings?

I’ve been saving for retirement since I started working after college (during I didn’t make enough). I signed up for the first 401(k) I could, and also socked money away in IRAs. The only time I decreased my 401(k) contribution was during the Great Recession when I felt the need to beef up my emergency fund.

I never thought to decrease my retirement savings to pay off debt until after I was debt free and read the argument for doing that. Oh well. Now that I have a mortgage I split my surplus between paying down the mortgage and saving for retirement/rainy day/big ticket items.

And, among your various forms of debt, how have you ordered or prioritized which debt to pay first?

Yes, – credit cards first starting with the highest interest rate, followed by my car loan. Now I just have my mortgage. My student loan was at 5% and very small, so I just paid the minimum payment until the load was paid off. Now the only debt I have is my mortgage.

Do you do the snowball method (smallest debt first), avalanche method (highest interest first), or some other arrangement (such as the most personally satisfying)?

Avalanche.

My emergency fund: I have a year’s worth of take home pay saved up. I’m at a point in my career where I could become a layoff target. Of course, I’m trying to avoid being a layoff target, but you never know. Also, I am the breadwinner so I want to make sure we have enough if I get laid off or can’t work for some other reason. I upped my emergency fund from 6 months to 12 when things got serious with my now fiance. I think one big factor to consider in building an emergency fund is whether you have people depending on you financially, and if you’re on the hook for home repairs and a mortgage.