by Hope

I completed my first read thru of Your Money or Your Life and am so excited for our book club discussion in a few weeks. With that being said, I have decided to start my work on the varying steps. Therefore tomorrow, I will start tracking EVERY penny in and EVERY penny out. I decided that the first of the month was the ideal time to do that…and it’s key to moving forward with the steps.

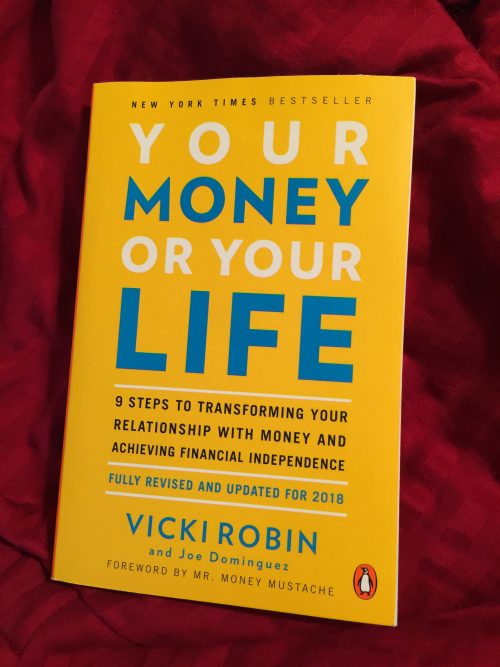

The Book

I read a chapter a night, and after the first chapter have not had any more reservations about the process. The concepts around Enough, Purpose and Values that are stress throughout the book really speak to me. I’m trying now to reveal too much. But needless to say, the theories presented in this book really speak to the heart of the matter for me. My relationship with money.

Book Club

My thoughts for our discussions is that we tackle a chapter a week. Is that too slow? I will post a synopsis and my opinion every Monday (beginning March 5th) and then we can use that for discussion for the week. I’ve never done an online book club, if you have suggestions I’d love to hear them.

With that being said, I am going to begin my tracking so that by the end of March I’m ready to do a full month’s analysis. I’m sure it’s going to be pretty funky since I essentially have no steady income, but I’ve got to start somewhere, right?

While this downtime is a bit stressful, I’m fully utilizing it to get my head on straight and focus on some things I really need to master. For those of you who have read this particular book, do you have any other books you would recommend? I am excited to move through this journey of changing my money mindset and relationship.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

I’m #12 on the hold list – don’t start without me!!!!

I’m reading the new book by Jesse Mecham who does You Need a Budget and I REALLY like it a lot.

Thanks, Sue, I will have to check it out!

Hi Hope! If you’re interested in making some more money, I highly recommend VIPKid. It is teaching kids in China via a skype-like platform. You can make more than $20/hr working from home, and it’s super fun! I’ve been doing it since February, and the extra income is a huge stress reliever!!

Check it out- https://t.vipkid.com.cn/?refereeId=8886146&refersourceid=a01

Thanks, Patti, I looked into them, even started the application process. But I don’t have that bubbly personality and don’t think it would be a good fit. I’m way too introverted. But thanks for the recommendation.