by Elizabeth S.

Hello from my dogsitting gig!

Huge budget update

This post comes with a bit of anxiety and regret. The paycheck landed Friday, and with it, a couple of surprises. It turns out that I was paid $2400 instead of $2193, and will be for the rest of the year. That’s because my CPP (Canadian Pension Plan, a federal pension program) and EI (Employment Insurance or what Americans would call Unemployment) are paid out for the year. But that’s not it…. I’m bracing myself here. I set aside money for rent on my check, and then realized a few hours later that I will be getting paid again August 30th. That’s right, this is an elusive three paycheck month.

If I wasn’t blogging about finance, I’d be thrilled with what I did. I sent $500 to emergency savings and $400 to credit card debt immediately. I’ve now done the first step of Dave Ramsey’s 7 Baby Steps! I have a little over $1000 saved in my emergency fund, as well as the boarder staying at my house and the dogsitting gig. I am unexpectedly kind of flush with cash. But the problem is I haven’t cut my spending. I am still spending quite a bit on going out and groceries. It’s funny, looking back on 2019, I didn’t go out much at all until June. It might have something to do with summer, or pulling myself out of an emotional slump after my relationship woes, or…who knows. But I can’t make excuses for it.

Spending, in images

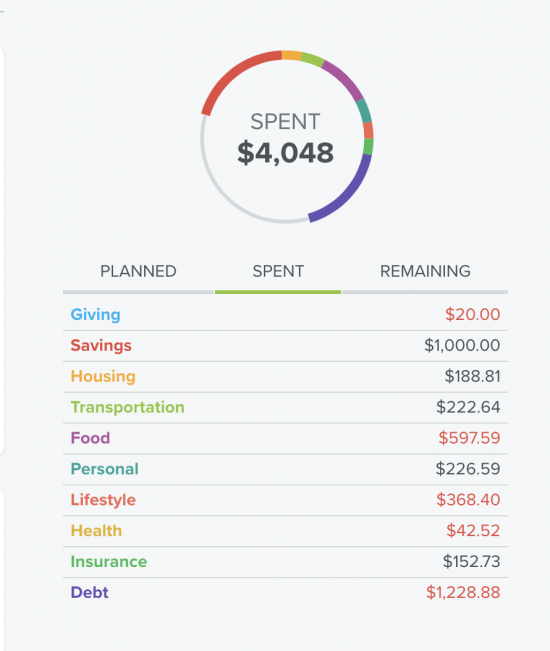

Here is an overview of my spending so far:

Every Dollar Overview

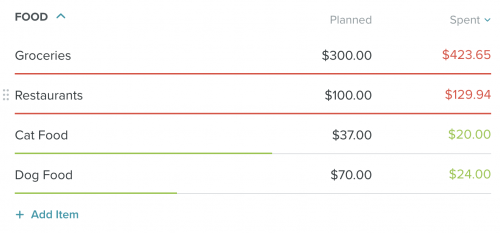

Food spending is off the rails (I’ve since corrected the dog food item to be 24.93 per the receipt below).

Food spending

Here is an example receipt. It includes some items I don’t normally buy, such as food for my pet sitter and prepared dog food because I didn’t have time to get the raw food together this week. It also includes paper towel, toilet paper, and BBQ lighters. I didn’t break out the items into separate categories, which might be messing with my numbers. Walmart Supercentre usually has items from 4-5 of my budget categories! I only have pet food, pet sitter, and groceries broken out so far, but should further break out household items.

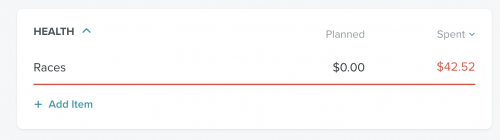

Here is a line item I didn’t budget for, but might help me down the road:

I signed up for a relay race in November. This fee includes entry, a long sleeve pullover sweater, and running gloves.

I’ve been thinking long and hard about my spending weaknesses. I’m spending way too much on food and going out this summer, more than I do ordinarily. I also haven’t been participating in my running club, which is completely free and probably the best thing I do with my spare time (for fitness, mental health, and really positive friendships). I’ve probably gained weight, but I haven’t weighed myself in a year so it’s hard to say. I wear mostly dresses and haven’t tried on fitted pants since spring. Oof, I don’t even want to think about that.

Health confessions

The reason I stopped running is that I had toe surgery a few months back for an injury I received in a triathlon bike crash in 2016. In addition, I have surgery coming up for a glomus tumor in my finger (second time around – I had this removed on June 2017, but they didn’t get it all). I have no long term health issues and don’t take any medication, but I am very active and hard on my body and end up injured about once a year. My surgeon suggested the glomus tumor could have been from trauma, and I definitely have banged my hand up enough times from sports.

I sort of put off run club pending healing, but there’s no point in waiting for my finger surgery. It’s painful, but not as excruciating as it is in winter (the glomus body regulates temperature in the hand, and cold weather is debilitating for me. Think shooting nerve pain you can’t think or see through). I could have seen a surgeon in June and had the procedure done with no wait, but I’m waiting for the head of plastics at the hand clinic in the best hospital in Toronto. I told him I was happy to wait till September to schedule a date with him. Nerve pain in the hand is so incredibly delicate, and I’m not taking any chances on this procedure the second time around.

Motivation by the way of race entry

Run club sent an email blast about a relay race and I signed up instantly. Races motivate me to start training! Typically, I hate running in the heat and only do Sunday morning run club in the summer, if any run club sessions at all. Summer is all about bikes and open water swims for me (more sports I’ve abandoned…eek). But I know I need this, and I have access to indoor tracks and treadmills if I really feel like a baby about the heat. That $42 was not budgeted for but should help me lower the spending on drinks and going out from here on. I can’t hit a patio after work if I have training to complete.

And yes, drinking is something I’m cutting back on. I can see from budgeting that I’m doing too much of that, and it isn’t good for anything on my plate right now (work stress, inflammation in my hand, sleep issues, fitness). I have a music festival at the end of the month ($52) and that will be my next entertainment event with alcohol. I’m going to budget for that out of my next check.

Does anyone have tips for spending cutbacks? I’m almost at the point of giving myself monthly cash for groceries because it seems too easy to go over with my card. I am meal planning and eating at home effectively, but still spending a lot. I’ll reiterate, I’m in the “data collection” phase, so there will be a reckoning of sorts at the end of the month.

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.

Until you decide it is enough there will always be a reason for over spending. It is summer, my friends are visiting, it is winter and I’m bored, it is Christmas and everyone needs gifts. You need to budget and when it is gone your done. You may live in an expensive city but if you don’t have money for a real emergency you are screwed. Please don’t use your parents as a backup it is for kids.

Hey Cheryl,

I’ve saved 21% of my take home income so far this month, paid off my dog’s vet fees with side gigs, and set up buckets for gifts and travel savings! I haven’t borrowed money from my parents since I was 24 and moved home from the US. It was $600 that I paid back in two weeks. No one is suggesting borrowing from parents!

You mentioned in a previous post you would go to your parents if you needed help.

I said I would before adding to credit card debt, but there a lot of options other than credit card debt, thankfully!

You’ve saved 21% because it’s a 3 check month. And you have stated your parents were your back up plan if you couldn’t pay the vet bills. You need to decide what you want more, to have some savings and get out of debt or to have fun all the time. I’m not saying you should never go out, but you should have a budget and be able to say no when the budget is gone.

Hi Laura! I will be adding to my savings on my next cheque, too! I said my parents were who I would go to before adding credit card debt….but why would I add credit card debt? I have enough discretionary line items in my budget that I can usually just borrow from myself and pay it beck in two weeks. After I collect all the data, I can tighten up the budget so it’s less discretionary.

Hi, definitely admiring your honesty.

I think awareness of your habits (overspending/ not working out enough) is the first step in the right direction. 🙂

Maybe a cash envelope system could help you stay within the budget. If you see 50% of the months budget is spent within the first week then you’ll really have to scale back and/or get creative.

Looking forward to supporting you on your journey.

Best wishes

Ahhh, bless you for the nice comment. I feel like I’ve made massive changes with my finances already but the readers here are a tough crowd.

I think you’re doing good. It takes time. You made a good debt payment, and put some savings away. That is some good forward momentum.

Thanks, Tootsweet! I hope I can keep the momentum going. Changing habits is hard, but writing here is helping a lot.

It is absolutely time to utilize cash in these two categories. Start by giving yourself $150 a week for groceries( and force yourself to really review whether the extra,spending is worth the extra time in debt). Trust me letting money go is much harder than swiping. Do the same thing with entertainment category.(It’s smaller so try cutting back by $25 a week or $100 a month) Ultimately your two main goals are conflicting(pay down debt without losing lifestyle). Your desire to pay down debt has to exceed your desire for fancy food and going out or vice versa where you recognize fancy food and going out is costly and your debt is going to remain.

Agree! The negativity of the comments are out of control. Elizabeth, you are brave to take on this highly judgmental crowd.

Just becoming aware of where your money goes is a big step! Once you see the big picture, you’ll be ready to focus on your goals – getting out of debt, savings, etc….

You are doing great so far!

I had to laugh at your post title, Elizabeth. I would say you’re really good at spending. It’s the not spending that needs work.

LOL! That made me laugh, too. A more apt title would be “I am really bad at budgeting”

Bluezette, I came here to say the same thing! LOL

I don’t know about Canada, but around here Walmart prices for groceries are higher than straight grocery stores, especially if you can shop the sales. The quality of the food is also way better. If you’re stuck on Walmart, make sure you are getting charged the correct amount at the register. In the states they’re really bad about keeping labels and the computer in sync. If you catch a price error you get $3 off or the item for free.

I know Walmart has the convenience of a one-stop shop but you should consider making a grocery price book. You may find out that you’re overpaying and where the best place is to regularly shop.

Hi Angie,

Walmart has the same prices as the absolute cheapest grocery stores around here other than the Chinese supermarkets. I’ve been to Walmart grocery in North Carolina a couple years ago and it was nothing like what I have. It’s a full grocery store with dozens of aisles of specialty foods (Caribbean aisle, Indian, Italian, even a German section, lol). Meat and produce prices are rock bottom. It’s the cheapest place to buy boneless chicken breast, for example. I hate Walmart and everything it stands for but shop there for sales.

As for quality, the “good” meat and produce providers are sold at Walmart for cheapest. We have other chains like Metro, Sobeys, Superstore – they are all more expensive. Walmart is closer to No Frills, Food Basics, etc. No Frills would be like your Aldi (but not as cool IMO).

By the way, lovely readers, you’ve inspired me to do a grocery post. I use the Flipp app and I shop sales religiously! I’m not married to any store. Within a mile of my house, I have (seriously) 8 major grocery store chains all with massive stores. I have a lot of options. I do buy higher welfare meat, dairy, and eggs, and that is important to me. That’s not pictured on the Walmart shop because a lot of those items were for the pet sitter at my house (save for the eggs from free-run chickens)

The good news in all this is you essentially “found” $2000 for the year with the $200 extra each payday. If it were me I’d have them auto draft $200 to your first debt each pay day at the beginning of the month and use the second to pad your emergency fund also autodraft). My biggest worry would be that you end up with lifestyle creep and end up in worse shape when payments start over again and you don’t have that money. Bonus for you if you shave $100 a month from grocery and entertainment($700 instead of $800) because then you could potentially be putting $1000 more towards debt and savings over the year. As I said, I really hope you consider going cash only for these 2 parts of your budget that present issues for you.

That’s my concern too. Wow, good idea with the autodraft for the extra $200! I’ll set that up now. 🙂 Thank you!

While I can understand the impatience people have to see big changes, I think getting on top of tracking what you spend is a very important first step. Progress over perfection. One thing at a time.

You are doing great based on what your stated goals are. Don’t let the frugal people get you down. This is not a frugal blog.

No it isn’t a “frugal” blog however it IS a blog about getting rid of debt and the poster actually asked a question and asked for input into pulling the trigger on using cash in her grocery category. Geez, some of you might want to consider your own “tone.”

Do you meal plan? And do you meal plan based on what’s on sale? Have you worked through your pantry and freezer? It can be hard when you live alone because so many recipes make servings for 8, but it helps save and cut down on food waste. And as for the pantry, I have enough pasta and canned tomatoes to feed an army. Try to incorporate some of that to cut down on grocery spending. This also works for shampoo, soap, toothpaste….. check your travel bags for all those hotel bottles and dig up those lotions you’ve been gifted. Use them up before you buy more.

I live alone but I have a revolving door of people at my house. I meal plan religiously and eat out of the pantry and freezer all the time. I need to do better at having people staying with me or stopping by contribute to the meals, and I’m going to start that today.

You mentioned Dave Ramsey so I assume you are following his plan including a zero-based budget. First, enter your total income. Then list expenses (look through your past receipts and payments) then subtract expenses from income to equal zero. If you have more expenses than income then start cutting back by looking hard at what categories you can reduce. Every month you start over so you will track and adjust until you get it perfect. As Dave says, you are telling your money what to do. He has an app called Every Dollar now that will make it easier but I still use an excel spreadsheet I put together years ago. It gets easier, I promise and the rewards are life-changing. Don’t get discouraged.

You’ve made good progress! Keep on paring down the grocery and entertainment spending and increasing the savings. You’re going to be fine!

Elizabeth- Maybe look at how you’re meal planning (or not)? I’ve started following/been inspired by “Work Week Lunch” on instagram. I haven’t subscribed to her recipes yet but I have learned from her process. Plan ahead, only buy what you need/plan to cook to eliminate waste, batch cook, etc. Just being more mindful about those things has helped me a lot.

to be fair, it w was just one or 2 folks that came with the judgement (even with your caveat) so lets not call out all commentors.

Anyway, you have to know what you are dealing with before you take action so I applaud your methodology, i think it will help you make more lasting change. One thing that could help if you do not want to use the cash or envelope method is open a different card for your discretionary spending (in your case food and entertainment). Transfer the money you have budgeted to that card and only carry that card around (and maybe a credit card for emergencies). That way, once there is no money on that card, you can’t spend anymore. You can decided to transfer your budget monthly, weekly or twice a month depending on how the psychology works best for your brain. Its a way to try the cash method digitally (i hate cash since i lose it easily so this is how I temper my spending)

That’s so wise. I have another free checking account that I don’t use (because it’s limited in transactions and has delays for transfers, but I can work with that). I think I am going to set this up right now.

I’m so excited to have a new “regular” blogger on here! Really proud of you for taking steps to reduce spending and take care of debt. It’s HARD WORK and a constant work in progress. Looking forward to future posts and seeing you acknowledge your financial achievements, however big or small 🙂