by Elizabeth S.

Editorial note: This post was supposed to be published August 6th but was lost in the digital ether. I will catch you up today and tomorrow and then we will be back on track with a real-time update Wednesday!

A lot has happened since I last wrote, in both life and spending.

Budgeting success thanks to a reader comment

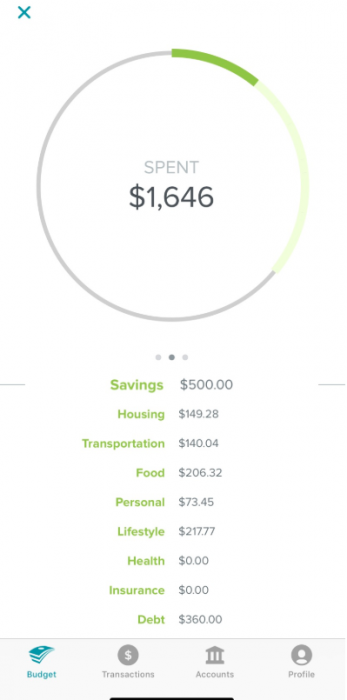

Firstly, thank you to Margann34 for recommending the EveryDollar app. It’s exactly what I need! With the Mint app, my student loan and investments wouldn’t sync, and YNAB is having issues with almost all of my financial institutions (they worked in the past – what a pain!). Well, I set up EveryDollar and spent the last six days tracking each transaction in there. It was eye-opening, to say the least. I went to the grocery store every single day since Friday, including on a statutory holiday Monday (laws surrounding holiday store closures have loosened recently, and most grocery stores are now open).

EveryDollar spending

Visit from an old friend

My best friend from Ottawa visits about once a year, and he came over Friday. We had planned to go out that evening, and prior to that, I made us steaks and served wine. We ended up heading out with mutual friends and dancing the night away. Between groceries for dinner, my Uber contributions, a couple of rounds of drinks, and dim sum brunch the next morning, seeing Dan cost me $210.

Downtown with friends

On the one hand, that is staggering, but on the other, that’s a really inexpensive 16 hours in downtown Toronto. We ate at home, went to a bar with no cover and $3 drinks (drinks are usually $10+ at any places people in their 30s go), and then went for cheap dim sum in Chinatown the next morning. I need to be more upfront with my friends about my financial goals, certainly. This isn’t a hit to my budget (yet). I have some room for this spending if I am “good” for the rest of the month!

A worrying turn for my dog

Rosie has an auto-immune condition that has been under control with diet for the past 20 months. Swimming used to cause her terrible rashes due to allergies, but she’s been fine for a couple of years. After being in the water for three days straight at the cottage, Rosie had a reaction from head to toe. On a related note, she had a few lumps removed in December 2017 and one ended up being malignant. She always has a few lumps, and the vet said to keep an eye on them and only bring her in if the lumps are bothering her. The swim caused her to go after one of her bad-looking lumps. I woke up at 4AM last week to her crying. There was blood all over her bed and the floor. She had gotten to two of her lumps and they were nasty, hard ones (the ones the vet doesn’t like).

In a terrifying coincidence, she also got into the garbage over the weekend and ate THREE old cobs of corn(!!!). I found out when she fainted from lethargy and her stomach was almost bursting, it was so taut. This has never happened in her life because I am militant about keeping the garbage locked up. Labs and garbage = moth to a flame. We had a double whammy emergency vet visit and I am so glad she survived without surgery. She puked up the cobs on her own.

What does this mean for the August budget?

I don’t know yet how this will look for the budget. Rosie has insurance, but the one thing the insurance doesn’t cover is lump removal as it was a pre-existing condition. Insurance should cover the visit over the weekend and the subsequent steroid prescription, but I won’t know for a few days how much my co-pay is. If she needs surgery, it cost about $700 all-in last time (tests beforehand, surgery, and follow up care) and that would eat up my entire savings account. It might be more responsible to put that on a credit card and continue building emergency savings so I don’t end up homeless. I’ll cross that bridge when we get to it. Today is the vet visit to check out what is in the lumps and determine if they need to be removed. I’ll keep you posted.

(This airline pillow-looking thing keeps her from biting her skin)

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.

I don’ know if it’s available in Canada, but in the US there is a thing called Care Credit. It’s basically a loan for vet emergencies (or medical/dental for humans, too). You apply like a credit card, and you are given a loan amount. That loan is 0% interest for 6-24 months (depending on how much you are loaned), after which the interest rate is something insane like 27%. You must make the minimum required payments on time; if you are late even once they automatically rise to 27%.

IF you know you will be able to make payments on time without fail, and can budget the required $$$ to pay off the loan BEFORE the interest-free promotional period is up, CareCredit may be a better option than putting the vet care on a traditional credit card. However, if you have any doubt about your ability to pay on time, I would not use Care Credit.

Thanks for the note! We do have similar programs here. For something under $1000, I wouldn’t hesitate to call the bank of Mom and Dad, either. They know I’ll get them back in a few weeks. I’m lucky that’s an option but I wouldn’t use it if I could avoid it.

I was wondering if you could make a line in your budget to start a savings just for your dog? I am not sure how often you get income, but even twenty dollars every two weeks could add up to about 520 dollars a year that you could use for any emergency care. I was also wondering what is included in your “lifestyle spending”. Could this be an area that you can potentially put some cash aside to start a fund for your dog?

Hey there! Lifestyle spending is broken out in the app – that’s a major category and there are subcategories breaking it all down. I am trying the David Ramsey baby steps first – $1000 in emergency savings. Then I will plan my savings buckets. I absolutely need money set aside for pets, my car, and travel. It’s also really important to me to not be a renter forever, and I want to buy a home in the next five years. It seems impossible right now!

At this rate, I should have $1000 in savings a month from now, and then I can plan my next savings goal. It’s a mental hurdle for me to hang on to money and not spend it. I think my next goal will be figuring out how to save 20% of my take home pay.

I am also a follower of Dave Ramsey. I have 10K left on a student loan and will be finished with baby step 2 possibly in a year. It’s hard but so rewarding. I figured a savings line for the dog would help as our pets are a blessing to us and need emergency care at times. I hope your dog is getting on the road back to health.