by Elizabeth S.

Checking on the progress of my debt reduction and savings strategies today! Here are the raw numbers of my accounts, comparing when I first started blogging here and today:

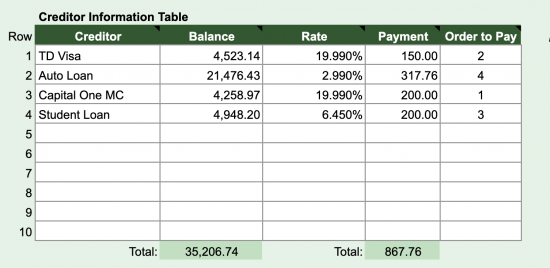

Debt Reduction

Debt 07/14/2019

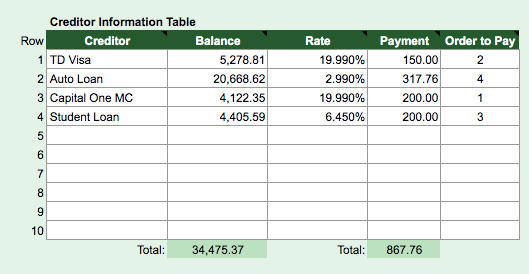

And Debt 09/30/2019

Debt reduction spreadsheet found at Vertex42

Savings Accounts:

Savings account: $2000

Increase of: $2000. I said I had $321 that week, but I spent the $321 in savings immediately. Since then, I’ve saved $2000 exactly and haven’t dipped in to the funds once.

Investment account: $379

Increase of: $379

I’ve put some side-hustle money in to an app called WealthSimple, which is a service targeted at making investment simple for millennials. I opened this account a few months ago with two $175 deposits and I’ve already made a little cash. I’m in an aggressive-growth portfolio, so my earnings actually dropped to $1 during some market volatility. Today, I’ve got $29 of profit in there. I’m using this account like an additional savings account and will be contributing around $200 a month to this.

Once I have more time, I’ll take more control over which investments I buy, as I actually quite enjoy the stock market. For today, I’m glad for the help WealthSimple offers. WealthSimple allows you to transfer money out relatively easily, so I like it for medium-term savings. These are funds I can transfer elsewhere in a year or two.

EDITING POST TO ADD: I use this as a savings account I can withdraw from pretty easily with next to no penalty. I am specifically saving this money in case I owe extra taxes next year.

Start investing better today! Click here to learn more.

Registered Retirement Savings Plan: $13 267.33

This is the Canadian equivalent of the 401K. My employer matches up to 3%, which isn’t much, but it’s free money so I make sure to take advantage of the full matching amount. I was going to contribute more to this fund, but the management fees are 1.94%. That’s a bit high, even for Canada where we pay a lot for financial products. I regularly see offers of 0.5% for management fees, and I’d like to open a new RRSP account once I have a few months of emergency savings saved up.

TOTAL SAVINGS:

$15 646.33

Net worth (based on total savings – total debt):

-$18 829.04

Takeaways

I’m going to give my efforts a B grade. Overall, my debt went down a bit. My savings went up significantly (considering I had none before), and I’m prioritizing saving over debt payment at the moment. If something happens and I lose my main income stream or need to move, I have almost nothing in the bank. That terrifies me.

I’m not thrilled that one of my credit card balances actually went up, but I’m going to make a payment of $100 to that today, and then continue to throw money at that as I can to bring it back down.

I think posting a monthly reconciliation of accounts is going to be imperative for my progress. As nervous as it makes me to review the health of my entire financial portfolio, it doesn’t make sense to hide from it.

Goals for October:

- Track all transactions diligently

- Post two spending diaries (chronicle all spending for a randomly chosen day, highlighting an average spending period)

- Make a concrete plan for killing credit card debt, with or without line of credit approval

Keeping it simple because tracking all transactions is difficult enough for me!

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.

I strongly advise you NOT to use the investment account until you have your credit card debt paid off. You have opportunity for guaranteed 19% returns by paying down your debt.

Sure it’s fun to watch the balances go up without doing anything. But the math is not in your favor.

I can’t comment on retirement savings because I don’t know the Canadian tax implications.

I agree with the others. You should contribute that $200 a month that you are planning on putting into an investment account onto the $8800 you owe on credit cards. Once you get rid of the high interest cards than you can play with the market. The $2400 a year will work better by relieving you of a definite $480 in interest instead of $100-200 a year in passive earnings you might make depending on market volatility.

I’m using that investment account as a high interest savings account. I can withdraw with almost no penalty. I’m using my freelance earnings in that account. Once I have a couple months of emergency savings, I’ll be aggressively sending all money to debt.

Is it earning more than the 19% you are paying on the credit cards? If not you are better off getting the high interest debt paid off first.

The market is never going to beat the 20% return you will get from paying down your credit card. That’s why the balance is going up!

I edited the post to add that I am NOT using WealthSimple for investing! I should have elaborated but was running to a meeting. I had been using a savings account with another bank that gave me 2% returns, and I decided to use WealthSimple instead because I can make a lot more with that account, and can still withdraw pretty easily.

WealthSimple is another savings account for me, and until I have about $6000 saved, my primary goal will be saving. If I lost my job, I’d need 6k just to live for 2 months, and that would be very frugal living including missing a couple bill payments.

Credit card interest is brutal, which is why I am keeping my fingers crossed for the 4.99% offer from TD for the line of credit!

I don’t understand this statement because your money is invested in the market. Therefore it is an investment account. WealthSimple’s savings account has a 1.66% APR, nothing like the 8% gains you’re seeing in a few months. I’m sorry to nitpick and keep commenting but it’s spreading bad information.

I think you need to simplify and focus.

1. Make a budget and stick to it. Include monthly savings for items/events you can predict (car maintenance, gifts, guest visits, taxes, pet insurance deductible, etc.).

2. Hide all access to your 2k e-fund. Make it a non-negotiable.

3. Save additional to top off your e-fund. Determine amount adequate to pay for 2 months of minimum cash needs (rent, utilities, anything you can’t put on a credit card or defer).

4. Use every spare dollar to throw payments at your credit cards. Do this as often as you come across extra money. Weekly, daily, whatever. The more you do it, the more motivated you will get to pay it off. No payment is too small or too often. Laser focus!!

Knowing where you stand is the first step, so kuddos to you for being honest about where the numbers are! Deciding when to save and when to pay down debt can definitely be a conundrum. I definitely think it’s important to have a chunk of money for a safety net, but consider if you really need that $6K in the bank right now. If you kept just $2K in savings, you could pay off your MC credit card with the other $4K and save a ton of interest. If you suddenly lost your income (which sounds like a relatively unlikely scenario from what you’ve posted), you could use the credit card for expenses until you’re reemployed and still pay less in interest than if you’d continued making smaller payments. I guess the thing to consider is how many of your expenses have to be paid out of the bank and how much you’re will to pay (literally) for the peace of mind of having extra money in the bank.

Is it just me or does anyone else think these are really strange financial decisions? Paying 19.99% in interest would freak me out more than having minimal savings.

I get it. If you suddenly lose your job, need to move, etc you need cash. I don’t think you need a lot of savings before aggressively paying down 19% debt but a minimum one month living expenses is a good idea. Three months is better.

What if you are forced to move out and it happens to be at a time when the market is down 10-20%? Would you be able to roll with it as part of the risk or would you be very upset losing $600-1200? You don’t get to selectively time when you need your emergency fund. That is why you don’t want it in an investment account. Also, even though you can withdraw it at anytime, remember you also have to pay taxes on the earnings.

Recessions are when layoffs typically happen and landlords reconsider their strategy and holdings.

Yes. Savings should be in an actual savings account or at the most invested in bonds. If you might need to pull the money out at any time do not put it in an aggressive growth portfolio. What if the market crashes right as you need to pay taxes? With a small amount of money, even 1% vs 3% interest is really not much of a difference and not worth sweating too much.

I think the comments here are spot on. I say you take your $2000 and seal it away as your emergency fund. That means ONLY for emergencies.

Start aggressively paying off your 19% debt, that is an incredible guaranteed return!