by Sara S

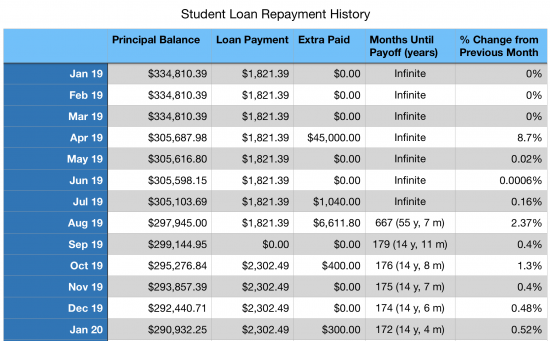

My husband was out of town at his grandma’s funeral this weekend, and I had some quiet evenings to do some reflecting. One thing I wanted to see was our progress with our student loan. Is all this hustling and cutting back making a difference? So one night I put together a new spreadsheet (because I know how to party).

And then I had a major reality check.

I’ve been good about tracking certain numbers, but I didn’t have one chart that showed all our progress. I especially wanted to see how much we’re really paying each month, and how much longer until this is all over.

Wow. Anything jump out at you? Here’s what made my eyes pop:

A year ago, we were literally never going to pay off our loan.

I did not understand just hoooow loooong we were paying off interest only on our loan. We were income-based for years, and then flat-out negligent. That means that less than a year ago, we were set to pay on this loan perpetually, always, henceforth, and forever. We were never going to shake this thing! How were we sleeping at night?!

I felt like we were making more extra payments than we actually are.

“Feeling” like you’re doing something and actually doing it are totally different things. When we refinanced with Earnest last September, our monthly loan payment jumped from $1,821.39 to $2,302.49, so it already felt like we were paying a ton of extra.

Even though it’s in our budget to put our monthly excess towards our loan, I hadn’t appreciated how many months we sabotaged our “extra” plans and used that money for other things. We’ve either paid ourselves less from the business and lived off the extra, or we’ve used that extra for necessary things that should have come from our emergency fund. Sloppy, sloppy.

This was a wake-up call. Yes, we’re making debt progress. I’m seriously grateful for that. Paying it off in 14 years is better than 55 years (and definitely better than infinity and beyond). But when we refinanced to a 15-year loan, we vowed to pay it off early. It’s time to actually do that.

The next auto-payment on our loan goes through this Saturday, and I’ve already scheduled an additional $2,015 to put towards it that day. (I’m using money from that refund check from our state, but we decided to save the rest. We were warned that once your state audits you, it’s only a matter of time before the IRS comes calling. So that’s cool.)

Our principal balance today is $290,932.25, so after this weekend we’ll pass $290,000 and hit the first mini-milestone we set for ourselves. We’ll mark our debt progress on our charts with our kids, and then enjoy some “real” pizza (after tons of homemade, we’re ready for you, Papa Johns).

That spreadsheet should be looking better and better these next few months. Stay tuned.

Incidentally, if you want a good basic primer on paying off debt, consider reading The Wealthy Post’s comprehensive article on pay off debt on a low income. That article is here.

Whoa! It really brings it home seeing it like that! I don’t recall the ages of your kids but having it paid off before they go to college is a great goal, if not earlier. In reality, if you plan on paying for your kids college, at this point you want about $250,000 saved per kid, allowing for private college tuition and expenses. But I would definitely prioritize retirement over college savings as well. Cheers to making progress!!

Thanks, Shanna! Our kids are 10, 8, and 5. I’ve actually been wanting to post about saving for college. I have so many questions!

This is the kind of thing that makes me want to just give up lol. There’s no way in hell we’d be able to save $250k. Our goal is to save for two years cc tuition, two years in-state university tuition. It’s a lot more help than we got and I still feel insanely guilty over not giving my son the best shot at a great education. Idk.

It doesn’t have to be $250,000, I think that is a very high estimate. They don’t have to go to private college. They don’t have to live on campus. Higher education is expensive, but it doesn’t have to be that expensive, unless they are going to med school or law school.

Unless you are a transfer student, or can prove you are living with family, a lot of schools make you live on campus for two years.

Unless the school your kid is attending is within driving distance on a daily basis, do you need to assume that they are going to live on campus for at least two years.

I am looking at the change from Mar 2019 to Apr 2019. You paid 45K, your loan balance dropped by ~30K. Is that right? Does it mean your prior payment wasn’t even covering interest — and the principal was in fact growing? Or is this an error and your balance due should be another 15K lower.

That’s exactly right–our prior payment wasn’t even covering interest. So we put our tax refund towards it in March, and about $15,000 went to interest and about $30,000 to principal.

So our principal balance wasn’t growing and it’s not a typo. We just had a ton of interest to take care of after months of paying too little.

W-dont despair! Many, many out of state schools offer good “merit” money as well as private schools. But good grades and good test scores are important to get that money without financial need. Some areas provide free CC tuition that is NOT finance based as well so those first two years could be totally free. State schools can be GREAT (and privates can be crappy) but even in-state you can be looking at $40K plus a year for tuition, room and board. Any savings you have is such a gift to your child to start them out debt free or low debt. One thing I recommend is having a conversation early on about what you think you can contribute financially and what your expectation for them to contribute is. I have seen my kids’ friends get in to their dream school only to find out there is no way to pay for it without massive debt, and that can be heart wrenching. So if everyone is on the same page going in, it manages expectations and makes a smoother experience.