by Hope

They say hindsight is 20/20 and I would definitely agree with that. I think we can all agree that I could have been out of debt far earlier if I would have just chosen a plan and stuck to it. While our life has really been what I consider a grand adventure and roller coaster ride, I wish I knew then what I know now.

I thought I would share a resource that I actually found way back then, but never fully utilized or stuck to. The debt snowball Excel template. I’m not sure what motivated me to go looking for this all those years ago. But I’ve used this same one every time I’ve become reinvigorated to get out of debt.

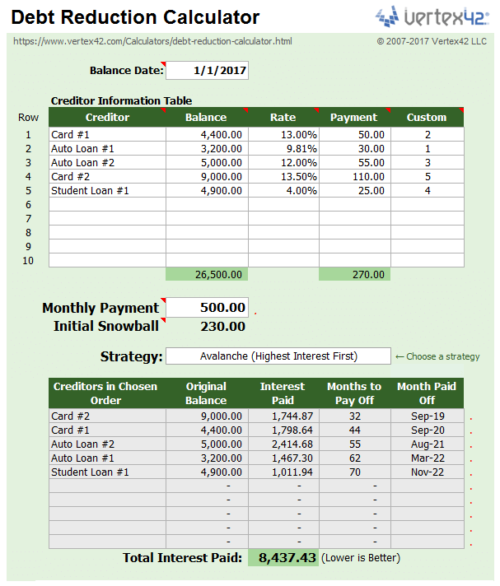

Debt Reduction Calculator: Excel Template from https://www.vertex42.com/Calculators/debt-reduction-calculator.html

Debt Reduction Calculator: Excel Template

If you scroll about halfway down the page, you will be able to download for free the Excel template. They have paid versions further down, but I don’t know what they include. I’ve only ever used this free version. (There are no affiliate links here, no tracking, just a link to a spreadsheet I use to this day.)

The screenshot above shows where you enter your data and then on another tab, it shows you exactly how much to send to each debt every month. And gives you a slot to enter any extra payments (that are always to go to your primary debt goal that month.) It’s a really great tool. And every time I “restart” the payoff journey I updated on my numbers and the date.

Do it now, sacrifice now

I wish I had stuck to this plan all those years ago. I wish I knew how good getting out of debt would feel. It would have been life-changing in so many ways.

While I feel like I’m finally making good strides I want to encourage anyone else who is just starting this journey or starting it again as I have many times… to stick to it. Do it now. Sacrifice now. Wait on those purchases. Wait on those trips. Your kids don’t need everything and to do everything.

Here I am with my kids almost gone, having struggled ALL THEIR LIVES and I’m just now getting to a place where I wanted to be when they were young. Make the hard choices now. You will thank yourself, I promise. And use this great tool as a guide.

Lastly, if you want a comprehensive article on the debt snowball method, you might consider reading Founder’s article on the Debt Snowball Versus The Debt Avalanche Method. Its comprehensive and worth the read.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

We used the debt snowball to get out of debt and it worked for us!

Now we use the savings snowball, save for one goal until it’s financed, then save for the next savings goal, etc….it’s much more fun than the debt snowball LOL!

Hope!!! Read the words you JUST wrote about getting out of debt again and then go read your post a couple weeks ago justifying how you’re going to slow down on paying off debt.

I am slowing down for 3 months for a purpose. While that may be an excuse to some. I’ve lived on the cusp of homelessness for 13 years now. To finally have a place of my own that no one can take from me, that’s big, giant. We’ve lived in some truly terrible and gross circumstances, I don’t have to and won’t do it anymore. It may not be your choice but it is mine.

It is not a whim or a long term decision, there is a definitive start and stop date, just like there is for my complete debt payoff journey.

These are the exact words you used when explaining your decisions back all those years ago when BAD readers urged you to make sacrifices to get out of debt.

You say in this post you made decisions you regret. How about going back through the archives and picking out a few actual decisions you made that you now recognize were the wrong ones? Add in how you justified the decision at the time, and why that was the wrong choice.

Its easy to say,” I wish I had gotten out of debt years ago”. When it gets real is when you identify the mindset that caused you to make the choices you did.

You’re giving some great advice in this post, Hope, I just wish you would take it.

Read this post, read your spending plan for October, read this post again.

Read this post, read your “A decision the BAD community won’t like” post, read this post again.

Your children are still young.

You are not debt free yet.

You are still struggling and having to take on debt for medical devices.

Follow your own advice! Put off the state fair and the clothing allowances and the college savings and focus on becoming debt free ASAP. Do it now, sacrifice now.

I actually did not have to take on new debt for my hearing aids, it was a calculated choice. I now have the savings to pay for those type of expenses. But chose to take advantage of the interest free loan to keep my EF in tact.

I’ve heard you talk about this spreadsheet before. By this time, you should also know that there is a tab to track your payments and balances.

I made a similar (but more detailed) spreadsheet for myself at the start of my debt payoff journey. I diligently kept it up to date with extra payments and it really kept me going and staying consistent. I’m disappointed that with all this time you haven’t actually utilized it other than for a quick calculation of unrealistic payoff dates. Only to be followed by taking on more debt a few months later. This spreadsheet could have kept you accountable all these years but you chose not to actually use it to its full potential.

I forgot to add… A spreadsheet like this is also immensely useful in ensuring your payments are allocated appropriately between principal and interest. I definitely caught Sallie Mae improperly allocating my payments a few times.