by Hope

Before you all come for me. Although, I imagine my last post triggered some of you and you’ve already let me have it in the comments. My budget in the last post was an IDEAL WORLD, not my reality and certainly not currently. Right now, it’s basics and debt.

However, there are two things I haven’t shared with you about my current finances. And based on the subject line, you can probably guess what one of them is.

I am saving for Christmas.

Saving Plan for Christmas

You will all remember that this past Christmas was a real struggle for me. But I ended up being really proud of what I was able to do with my $2.

Right after Christmas, I knew that I did not want to be in that position ever again if I could possibly help it. And I started interviewing for this new role right after the new year so I was pretty full of hope for this year.

I’ve written before about my Not Spending $5 Bills.

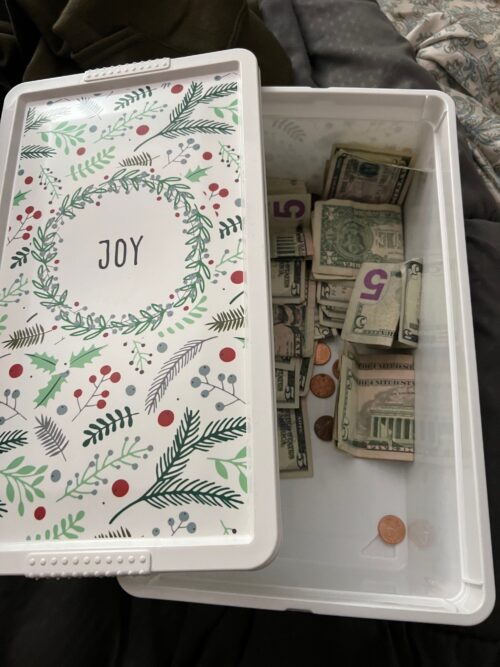

That is how I’m saving for Christmas this year – change and $5 bills. All go into a shoebox in my closet.

Again, I know this won’t sit well with the BAD Community. So I want to caveat this with two things:

- I don’t have cash very often so this is not a mass amount.

- Playing games like this helps keep me motivated.

We shall see how it turns out come the end of the year. But I wanted you to know that I am doing this. (This is one of those things that make personal finance, personal.)

I will share the other thing I haven’t shared yet in a week or two. I am hopeful it will make at least a few of you happy with me. But you never know.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

No one is “triggered” by you; just annoyed at how clueless you always sound. And you always have some excuse why you’re doing something foolish, like “That’s what makes personal finance, personal.” By the way–you don’t need that comma.

Have you ever built out amortization tables for all your debts to see the impact of making even $5 dollars of payment? With credit cards at 30% interest, it makes a difference. Vertex42 has some great templates I’ve used over the years. There’s one that let you list out debts side by side in columns and you could play with how much extra you pay to each on a monthly basis.

No one was “triggered” by your last post. People were very concerned because your first priority was an imaginary budget, rather than one that will help you navigate the very precarious financial situation you’re in. It’s alarming to see someone who’s in such dire financial straits operate with their head in the clouds.

Maybe folks get triggered because you use the word game? but it is 100% your journey and not ours. it is good to save all your small change and whatnot, but i want to add the caveat that you would use this to help yourself, before anything else. i understand family and christmas is big, but your kids need to understand you’re trying to live and survive.

I don’t think it’s fair to say people are triggered. It feels like there is a lack of honesty and questions that are avoided for a while (like why your mortgage changed, which wasn’t answered till last post). It’s hard to give advice when it feels like there’s a lot of left out information.

Hope,

This seems like a good balance. While in an idea world you could take that extra 5 to 20 bucks a month and put it on debt, the reality is that only works if you remain motivated. If this is what does it for you, I see zero problem with you saving in cash vs in a savings account at these kinds of levels. Could you earn a few % of interest,yes. But is 4% interest on a couple hundred bucks. I can easily see how you might blow way more than this in a year due to lack of financial discipline. If this helps reduce that Fill the box!

But her credit card interest rates are at around 29% not 4%. Putting this money (which looks to be around $100) would save a lot if she put it toward one of those high rate credit cards vs throwing it into a box. I totally understand wanting to save for gifts and this looks like a drop in the bucket when you feel overwhelmed with a lot of debt but this could be a big payment on one of those lower balance cards. Nobody is “triggered” but make a game of throwing money in the box for your cards and making extra payments. Your adult children will still love you whether you buy them Christmas gifts or not!

That’s true and in an ideal numbers world I would agree with you. However, this is a human being on the other side of this equation. Consistency, reliability and a plan that actually works long term will save a lot more money than a single payment. If saving $5-$10 bucks at a time makes Hope more likely to stick to the plan then I say whatever works. I’d rather see her toss the $5 bills in a box than blow them on something throughout the month and this way, when December rolls around she is confident and ready to tackle her debt rather than self conscious and depressed. Not everyone’s first priority is debt reduction. That doesn’t mean they can’t be successful getting out of debt, it just means they make the conscious choice to go just a little bit slower.

yeah but at this point hope could not possibly go any slower at her blogging away debt journey. some of these people who are trying their best to give her very good advice have seen her dragging her feet for years and still not getting anywhere. if debt reduction is not her priority then why is she still here after all these years? people are very frustrated with her and i will say again that i am just so grateful that she is not my child.

People aren’t “triggered”. They are trying to prevent you from becoming a financial burden on your children, but you seem hell-bent on doing that. Because who’s going to bail you out when your parents are gone and you still haven’t gotten your act together?

I’m an all or nothing person. Once I find the optimal solution I stick with it. So when I was paying down debt it was extremely motivating to go online and send extra debt payments and see my balance going down. Any time I saved money, or had extra leftover, I went online the same day and sent in a payment (many times it was even as low as $5). Personally, I found it very gratifying to send extra debt payments and that was my “game.” Saved $10 with a coupon? I sent $10 in to my loan immediately.

To me, it was atrocious to have any amount of cash laying around when I had debt at 10% interest. But in the grand scheme of things your $100 in the shoebox would only be saving maybe $50 on the year in interest. So if it keeps you motivated and helps you feel like you aren’t restraining yourself (and therefore more prone for a spending blowout one day) then I guess it’s an okay approach as long as the total amount isn’t getting too high and you’re not missing any minimum payments. If you’re on track to miss any payments, you better be cashing out that stash.

I would compromise. Save up your change and $5 bills until you hit your Christmas goal ($200? $500?), then immediately start putting the extra money to debt repayment.