by Hope

Some of you will remember last fall when I was trying out different sites to earn cash. Doing surveys and various other online tasks to see which legitimately paid. In most all cases, I determined that they are not worth my time. However, one of my finds did stick during that journey.

Stash <-not an affiliate link touts itself as an Investing App for Beginners. So you know that is perfect for me. I signed up last fall and began invest $5 a week. It truly was a decision driven by the opportunity to earn $75 for trying it out. (And yes, I did get paid that amount after my first 30 days.)

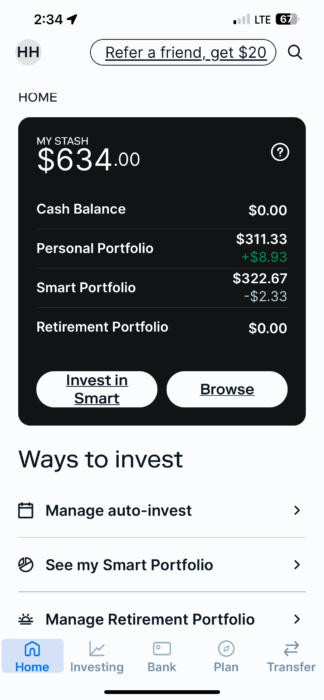

As of today, here is my balances:

It has been so easy and so mindless as far as deciding what to invest in. Now I’m up to investing $35 per week to the two different portfolios. I’ve got all my settings set to re-invest. And my plan is to just let it ride.

If you would like to try it out…and help a girl out, this is an AFFILIATE LINK that bonuses me $20 in stock when you sign up.

My hope is that I can increase my investments significantly by the end of the year or early next year as I begin to reach some big paying off debt goals. But I haven’t sat down and really thought that thru yet.

I appreciate how communicative Stash is about my investments. How easy it is to see where my money is going? And how easy it is to change my risk level and re-balance my portfolios.

While I admit, I truly do not know what I am talking about when it comes to investments. This has made me feel like I’m going in the right direction. And it’s been a consistent “savings” platform for me. (I know it’s not a savings account, I recognize the risk.)

BAD Community, what do you think of this tool for beginning investors? I’d love to hear your more experienced feedback?

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

i would suggest that you look at reviews on trust pilot. looks pretty sketchy to me and apparently a lot of other people.

Is the $8.93 what you have earned since October? It looks like Stash charges $3 a month. There are SIGNIFICANTLY cheaper robo investment apps if these numbers mean what I understand them to mean. You are losing money using this service if you pay $3 a month.

I get that you started it for the free money. Personally, I would have just opened it and let the $75 ride and added nothing else. Actually, after earning the bonus I would have pulled everything and sent the extra $75 to pay down debt!

I don’t like these apps because they just split your investments into other silos and can be easy to lose. You’re likely to only keep small amounts in there so the $3 fee can take a decent chunk of your earnings (right now your fees are taking over 5% which is really high). They also encourage you to buy/sell individual stocks making it more volatile and also easy to forget a capital gains form at tax time. Most people would be way better off opening up a Vanguard account, stick their money in a sp500 fund, and calling it a day.

That being said, you really have no business doing any type of investing (especially high fee investing) while you have credit card debt costing you 30%. If you are committed to investing in some way, you should direct it towards an IRA or solo-401k and at least get the tax benefits. It’s not as exciting, and it doesn’t have a flashy app. But that’s how investing should be unless it is 100% play money, which it is not for you right now.

I agree. Invest in paying down the credit card. That interest is crippling you.

Are there fees associated with this? What are they? What are you investing in? Is it a specific stock or a group/mix of stocks (an index fund?). How did you pick it?

It’s $32 per year. It’s a mix of stocks, bonds, ETFs, etc. You choose your rick level and broad categories and then the investments are done automatically.

I suggest you simply sopen a regular old Fidelity brokerage account and set up to auto-invest monthly in a regular old index fund such as VTI. Simple, reliable, no fees.