by Hope

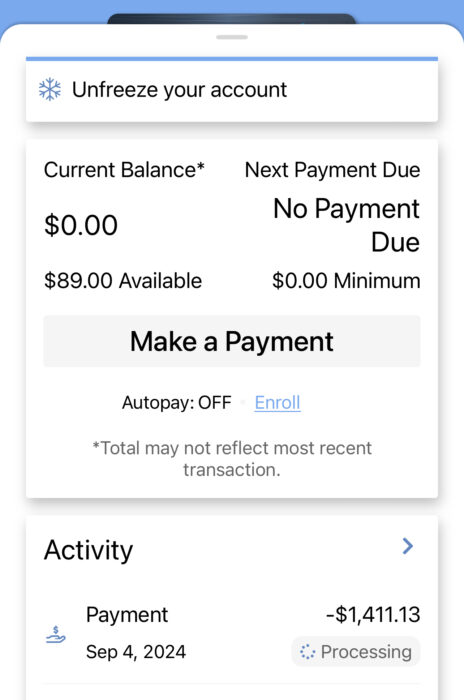

Another debt bites the dust. Amazon CC debt be gone!

Some of you may remember that this debt has been almost gone before…just a few months ago. And then I went a little spend happy and ran it back up. No more!

I’ve hesitated to cancel this account due to it being my second oldest credit account so I know closing it will adversely affect my credit score much more than the other cards that I’ve already closed. But just like then, I’ve decided that I do not care about my credit score. I have to remove even the temptation to use this car again.

This card will be closed. Once the payment is cleared and settled.

The total paid today is: $1,412. And it feels soooo good to have another account paid in full.

(Sidenote: the two cards that I’ve already paid and closed have emailed me almost weekly to get me to reinstate the cards. Is that normal? But I am not even tempted.)

What’s Next?

Based on my last debt update, my plan was to pay off my Frontier credit card next. And I figured it would take a couple of months because of my income and the balance. But now I have full time income. HOWEVER…

I’ve mentioned at least once, maybe a couple of times, that Princess must get her wisdom teeth out. And we did get a consult last month. The total for the surgery will be $4,010. I paid $400 of that at the time of consult. We have scheduled the surgery for next month (October, 2024) after her mid-terms.

So my plan is to pay the Frontier card in full at the beginning of October. Then I will have to turn around and use the card for the surgery. This will save me 1/2 month of interest accruing. And then I will pay it off again in its entirety again in November. And then cancel the card.

Is this a good plan, a good use of credit card at least temporarily? Or am I making a bad call with this plan?

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

Can’t Princess get dental insurance through her new job?

New job doesn’t start til the middle of next summer. And taking off for dental surgery can be intimidating for new to the workforce young adults. Trying to alleviate that pressure as she begins adulting. Not to mention the pain she has been having.

Even when we had “good” insurance, it didn’t really cover this type of surgery as it’s lower than the deductible.

Oh, I thought you had said Princess would be starting a new job soon. Will you be helping with her rent until next summer then?

She has gotten a part time job. I will help her through graduation as needed (with a limit.)

And she’s already got a full time post-grab job. And that job will provide her with full benefits!

Wisdom teeth-you need to get more quotes for the wisdom teeth. That is outrageously expensive, especially in a lower cost of living state, we live in the San Francisco area of California and we just did that for my son this summer and it was half of that with full anesthetic and four impacted teeth.

This also includes full anesthetic and four impacted teeth as well. None of her’s have broken through the gums.

Even when I had good insurance, when Gymnast got his removed in high school, I paid several thousand dollars.

Princess has had some bad, really bad experiences with dentists, so finding a recommended surgeon from someone we trust was important. And getting it done near her was also a factor since it is the school year. (In hindsight, I should have pushed her to do it several years ago.)

Paying of Credit Card debt is never a bad move. So, you will owe the dentist $3600. Do they offer a payment plan themselves (don’t open a new line of credit for this) Do they offer a cash discount? How much can you save toward this in the next month, or until

the CC bill would come due? If you reduced savings and other earmarked amounts? Because your savings aren’t earning anywhere near your CC interest rate, so you should try to knock it out in a month or two and then get back to savings.

My plan was pay off the Frontier CC, then 14 days later use it for the surgery, then 14 days later, pay the CC off again (and closing at this point.) I will not pay any interest for this type of quick use and get the airline miles for use on future travel. And then close yet another CC, fully paid off!

So, I have to be clear here before you look to readers for advice. Most people reading this site have dental insurance, or an emerency fund big enough to not have to put a medical expense on a credit card. So most advice is going to be helping you chooose among the limited options you apparently think you have.

However, I’m not sure you even bothered, but this is a list of colleges around where Princess is that have dental services for students included in the fees. At least find out.

https://www.google.com/search?q=colleges+in+atlanta+with+student+health+dental+services&sca_esv=c4c1450a5839235a&rlz=1C1GCEB_enUS1111US1111&sxsrf=ADLYWIKyv9Yj15VrgDiwU6_BOMWJer81ng%3A1725817306396&ei=2uHdZqb9F56iptQPxrqJiQ4&ved=0ahUKEwim0vq78rOIAxUekYkEHUZdIuEQ4dUDCBA&uact=5&oq=colleges+in+atlanta+with+student+health+dental+services&gs_lp=Egxnd3Mtd2l6LXNlcnAiN2NvbGxlZ2VzIGluIGF0bGFudGEgd2l0aCBzdHVkZW50IGhlYWx0aCBkZW50YWwgc2VydmljZXNIAFAAWABwAHgBkAEAmAEAoAEAqgEAuAEDyAEA-AEBmAIAoAIAmAMAkgcAoAcA&sclient=gws-wiz-serp

We’ve actually used dental and dental hygienist schools forever for our dental service. (I’m pretty sure I wrote a post on this 7+ years ago because it was an every 6 month type of thing for us when we lived in Williamsburg.) Even my parents use this service where they live in Texas.

I’ve not found oral surgeon services to be as easy to find at the school level. Nor am I sure I would go that route.

I could pay this in cash. But it would delay paying off my Frontier credit card. Because I can’t do both in the month of October. By paying off the CC, then 14 days later using it for the surgery, then 14 days later, paying the CC off again (and closing at this point.) I will not pay any interest and get the airline miles for use on future travel.

The commenter means that the school fees that princess pays may include dental coverage. Please look into this before you shell out $4000 for something she may have insurance coverage for.

They do not. I asked about health insurance, etc. during parents’ weekend her first year at college.

Many moons ago, when I was in college, they offered a stand alone policy for collect kids. Her school does not.

Believe me, I’ve reviewed all options (and have done this a couple of times since 3 of the 5 kids have already had this surgery, Gymnast just a couple of years ago.)

You’re real big on travel points when you have so much debt. Any interest will cancel our your travel points.