by Hope

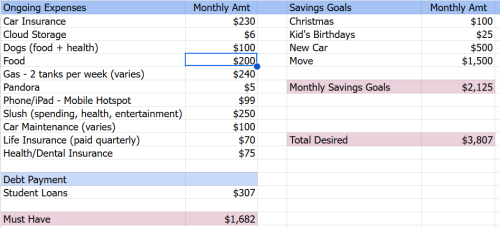

This is my tentative budget for after the house sells.

The items on the left hand column are “required”, the ones on the right are “goals”. The total needed to live comfortably $3,807. Getting rid of my credit card debt and housing costs will be a huge weight off my shoulders. What am I missing or forgetting in this budget?

One thing to note, is this budget was created with the idea of traveling and car camping in mind (see all the gas,) but for the bulk of the summer, I will be stationary. The plan during the months I’m with my parents will be to put all monies not spent into savings.

Again, the two year goal is to save enough to be able to buy land for a tiny house. Thus, the $1,500 per month for Move. After 2 years, that will be $36,000.

I will be posting my “what will I do with the house money plan” in the next few days. It’s a really soft plan as I’m not sure how much money I will walk with. The current guesstimate is around $50K, but again, that’s a really loose estimate.

House Update

The house is currently under contract…again. Since this is the 3rd time, I’ve learned not to count my chickens before they hatch. So we wait…

It did go under contract to one of my “exclusions” with the realtor. A family who had seen the house a couple of times before I signed the contract with him. In fact, they didn’t make an offer until the day the professional pictures came back and it was going to be listed on MLS. So I am saving 3.5% in realtor fees if this one closes. I am paying the buyers’ agent 2.5%.

They had 3 contingency periods, the first has expired. They’ve put down $1,000 in earnest money. And the inspection happened this week. The second contingency period ends Sunday. If we get through that, I feel like it will most likely close.

But again…just waiting and focusing on work.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

I don’t even know where to start. If you really are hoping to go car camping, you’ll need a lot more car maintenance funds. And $50 a week for slush fund when on the road is nothing. Let’s think this through. You get a coffee and a snack to get reliable internet for a few meetings and get out of the rain or heat for bit ($15), buy some ice ($6), pay entrance to a national park ($20), and get a fuel canister ($5). 3-4 things and you’ll already be out of money for the week. Need to do laundry in a laundromat while on the road? Easily 1/3rd of your weekly budget. It’s doable, but definitely doesn’t sound fun or freeing. You will spend all your time working, planning, driving, troubleshooting, and looking for somewhere to sleep. To me it just is just setting you up to overspend under the guise of “it’s my dream! I’ll only be able to do this once!” or having an car emergency. Then coming back home with more credit card bills.

I really think you need to take a pause on car camping for and regroup. I’m not saying forget it altogether. Go to your parents, help them for 6-12 months, and SAVE the money you would need to go on the road. It’s foolish with your track record to think that you can have fun, earn a FT income on the road, and save for a house in cash all at the same time. Whenever you get a big contract you tend to loosen up and go on a spending spree. It will mean so much more if you plan it out (including a rough route), save for it, are able to fully immerse yourself and enjoy it, and come back debt free. Then start your next phase of life settling down again.

I hope your house closes! Although I disagree completely with you selling, I do hope you can close this chapter and move on. You may owe for your home photos and any expenses your realtor took on, so keep that in mind.

Secondly-you are missing general emergency fund savings which should come before future house savings. You should have at least $20K in emergency funds before you work on the rest of it, based on 6 months of living expenses rounded down significantly. You also lack long term care insurance and retirement savings. You should be paying into that before any other account. For transparency your budget should also show what you spend monthly on work related items. I realize you pay for those separately but the money coming in has to cover all of it, so showing what your bottom line costs monthly for your business is important as it does affect what your income needs to cover.

Additionally, how are you going to make sure you don’t run up credit cards again? You clearly need to close or turn off all of them but one or two. You are also someone who should not be putting everything on a card for points. Points and Miles have been heavily devalued this year in any case, so it is not worth risking another credit card debacle to try and have points or miles.

oops-back here to add, where is your storage unit in your budget? Wedding and grad expenses will come out of discretionary pot? How did you come up with your food budget? If you are on the road, you will have more expenses to eat healthy food. I assume at your dads you will help with grocery bills for the household. I can’t see how that can be $200.

Hope,

This is much better. I suggest adding a savings category to cover miscellaneous extra randomness. The savings for when you need car repairs that weren’t planned for, tires, etc. You are going to have more wear and tear than you think there. Plan for a few hundred or so per month and you will have an emergency fund to tap for situations like this.

Also, add a 2nd column here to your budget so at the end of the month you can look at what you planned to spend and add up your actual spending to compare the two. This will make it much easier for readers to give you feedback but also you will be able to see the real facts yourself easily. This will help you to prevent falling back into the same old habits.

Yes, tires. I am on the cusp of needing them now. That may be one of the things I do right after the house sale. I’m going to plan a visit to Discount Tire to have them evaluated before I leave for Texas again.

So you think the $100 into a sinking fund for car maintenance isn’t enough…I’ll definitely consider that especially when it comes time to travel. I doubt I’ll drive much for the summer in Texas. Outside of church on Sundays, I will be focused on work and caring for my parents. (My dad does the shopping as its really his time out of the house. He enjoys it. I would just order and do Walmart pick up as I have done here in Georgia.)

And yes, I love the idea of a tracking worksheet. Will work that up for my revised copy in the coming weeks.

Hope, just some thoughts…

1.) Where in your budget is your storage unit cost?

2.) You no longer have minors living with you. Life insurance isn’t necessary anymore – you have set your kids up well to survive in their own without a payout upon your death. Ditch the life insurance and put that extra $70 a month towards savings or debt.

3.) Are you going to reimburse the realtor for taking the pictures since you aren’t listing with him?

Yes, I did forget the storage line item, but added it as soon as it was pointed out.

I’ll post a revised budget in the coming weeks before this takes affect.

Life insurance has definitely been a question? I didn’t make any changes before my term life expired last December. After this house sale is complete, I will revisit that line item and make a decision. I feel like I should keep a small policy to cover my end of life costs so that isn’t a burden to the kids, but you are right, I don’t need a $250K policy now that the kids are grown.

If the house closes with this FSBO contract, I will be paying the realtor $250 for the pictures. If it had made it to MLS, I would have had to pay $300.

this could be progress, although I think it needs more practicality to really set you up for success.

Like someone else mentioned, the storage unit payment is missing.

A slush line which includes “spending” is too vague and is going to let you off the hook too much. Give yourself a small amount to “blow”, like 25-50 and budget out the other items that go into this. Base health on your copays and/or whatever reasonable anticipation of expenses under your health plan.

I would take those savings goals off the table for now, and reintroduce them once you’ve rebuilt some model of regular income. Whether that is actual regular income or one of the methods of budgeting from variable income (hills/valleys, etc). You’re still going to be in survival mode for a while as you regroup. I recommend all income after expenses go to building an emergency fund first before other savings goals. You may be thinking that you can skip to your goals and just raid them if you need the money, but I think you will benefit from the exercise.

Also on the topic of savings goals, I think you should consider moving savings towards specific purchases such as gifts over to expenses as a sinking fund. I wonder if calling them savings goals is abstracting them away from spending and “slushifying” them, again perhaps enabling methods of getting yourself off the hook budget-wise. It may seem semantic but I reiterate I believe the benefit is in the exercise.

I appreciate these suggestions and will roll them around in my head over the next couple of weeks as I firm this up.

I was thinking I should create two budgets – a stationary one and a travel one because they will look very different.

$240 a week on gas, I am surprised. If you’re planning to stay put with your parents, do you need to fill up 2x a week? I thought your mom was mostly staying home vs going out to apppointments. And outside of driving back for graduation/wedding stuff – it seems pretty costly – but then I buy the lowest grade of gas.

I so hope that you can cut down on your student loan/credit card debt with the home sale money. Also, now that you have no kids living with you – can you pay off cards and close them off?

$240 per month. This budget was made with travel in mind. I noted in the description that while I am stationary for the summer, the “extra” monies would be put into savings versus be re-allocated.

I cannot read, sorry! Ok $240 seems not too shabby. Hopefully you come in under on gas etc so you can allocate extra money elsewhere!

I think you should not save for land for a tiny house this aggressively while you still have so much student loan debt and no retirement savings.

This is an improvement, but it still isn’t the full picture. I’d like to see a regular, ordinary budget, showing us the complete overview…income, expenses, debt and savings. Your bills are not your actual expenses, unless you are also tracking all of your spending (again, budgeted/actual), so you can see where your money is going, and where you need to make changes.

I think it would serve you better to call your categories what they really are, as I stated. “Must have” and “desired” don’t really say much without the additional info to round out the view. I do agree that the slush fund should be further subdivided, again to have a much clearer picture of what your spending looks like.

Life insurance. Since all your kids are grown, do you really need this? I mean, at the max you might need $7500 for a funeral etc if you pass. Your debts would just go away. I cancelled mine after the kids were grown. I bet you could get a very small policy much cheaper.