by Ashley

Has anyone heard about the product OnTrajectory before?

It was recently introduced to me as a way to plan and make financial projections way further out than what I’m used to doing (which is to say…basically a month or two at a time).

But not only that – the software allows you to see how simple little lifestyle changes can amount to HUGE financial gains across time. Like that specialty coffee you may get a couple times a week? Let’s say it costs $5 three times a week for a total of $15/week. Across the course of one’s lifetime ($15 x 3536 weeks) = over $50 GRAND spent just on coffee! Multiply that by an assumed 3% inflation rate and you’re wasting over $100,000 on coffee!

This intrigued me. What might the program say when I plug in all my financials?

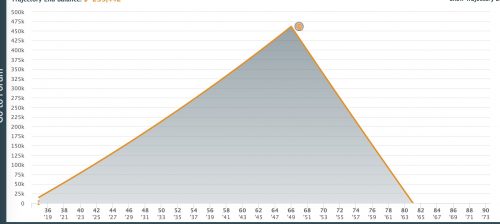

I gave it a try through their 14-day free trial program and was pretty surprised when – right off the bat – it warned me of a potential shortfall when I get into my 80’s.

But they don’t just leave it at “oh, you’re screwed!” – there are realistic suggestions on how one might save more or reduce expenses to make sure you aren’t outliving the money you’ve saved.

This is of huge importance to me given everything I’ve seen and been through with my father’s dementia. So far, we’ve been able to support him on money he had earned in his lifetime. But his memory care facility costs $7,000/month. Yes. SEVEN THOUSAND A MONTH just for rent. It’s incredible the cost of high-quality memory care. And that’s a pretty competitive price for his area (Austin, TX). There are cheaper facilities, but if you’re looking for high quality care….that’s about the typical going rate.

I’ve always said – I don’t care if I have no inheritance, just as long as my parents are able to pay for their own end-of-life expenses, I’ll be happy.

I need to make sure I’m doing the same for my kids, too. And with On Trajectory…..well, I can see some changes need to be made. 😉

Thankfully, I’m young. I still have a lot of financial “what if’s” hanging out in the universe in relation to my marital separation. But once that chapter is closed and I move onto whatever lies ahead, it will be much easier to have a clear-cut picture of what monies I can save and invest, where I can potentially cut expenses, etc. Getting fully out of debt is a BIG part of that picture!

I will say, OnTrajectory seemed to have a steeper learning curve associated with it than some of the other financial products I’ve used (e.g., YNAB and Every Dollar), but they do send out helpful email tips and there’s a whole guided walk-through of the program that you can try out to make sure you understand how it works, etc. There is a huge difference between YNAB, Every Dollar, and OnTrajectory though. The latter two are focused on short-term planning while OnTrajectory is projecting your long-term finances, making the additional technological learning well worth it.

I’m curious if anyone else has heard about and/or used OnTrajectory? If so, let me know! I’m curious to hear about your experiences and whether it’s helped shape some of your own financial goals!

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Freshly 40, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

Hi Ashley,

Until I found your blog, I had not heard of “OnTrajectory”, so I decided to check it out. I’ve signed up for the free 14 day trial via your link. I went through the initial setup and the site tells me that my trajectory end balance is well above zero and that as of right now, I am not looking at a short fall in retirement assuming a retirement age of 65.

I find the site to be very interesting, only because I don’t think I’ve ever seen these types of simulations available online before. That is to say, I’ve seen financial forecasting models used before, but only by my financial advisor. It’s pretty neat to see a web site/service that let’s the average person (not a financial advisor) do some predictions on his/her own. I’m sure there are probably other services/sites out there that do similar things, I’ve just not seen them yet or used them.

I will see how the free trial goes for me, and then decide if it’s a service I think is actually worth paying for or not.

Thank you very much for this post, and I am enjoying reading your blog!

-Pop Budget

I admit I’m a bit suspicious about their service given the graph you shown. Even with very simple assumptions, the straight linear graph is kinda odd. Even just assuming simple compound interest should show some exponential curve to it.

I’ve had fun playing around with firecalc, it’s free and seems more sophisticated then what this service is showing.

Tyson here, I’m the founder of OnTrajectory and happy to answer any questions you all may have.

For csdx, the reason you don’t see a curve in the screenshot provided in the article is due to the fact that OnTrajectory displays results in “Today’s Dollars” which automatically adjusts results based on the effects of Inflation — this tends to flatten curves.

As for a comparison to FIRECALC, our tool is far more flexible and deep — allowing you to model future Income and Expense assumptions as well as include various types of retirement accounts and model their specific tax-handling. It’s a much more powerful tool that can get incredibly complex based on your unique situation.