by Susan Paige

House mortgages, credit card balance, student and car loans are types of debt you might be currently busy paying off. It is common knowledge that paying off your bills on time is vital because otherwise your credit rating can be affected. A prudent way forward is to clear off your financial obligations to have a healthy personal economy.

Listed below are some vital tips to keep up with your debts while also saving for the uncertain future. It may sound a bit counterintuitive, but it is important to have some ‘just in case’ money before you think about debt.

High-interest Credit Card Debts

Nothing is easier than piling up a huge credit card debt. After you have it , it is difficult to clear it out since the interest are high if you don’t pay more than the minimum that is required every month.

Before getting one, take a look at the credit card statement and check out how long it takes to clear the debt just on the minimum payment so you can be prevented.

Private Student Loan

The private student loans have a higher rate of interest compared to the government student loans. At the moment, the rate on private student loans falls between 6% to 14% bracket whereas government loans have an interest rate of just 5%.

Opt for government loans, which are payable in less time and allow you to focus on more pressing matters at hand.

Establish an Emergency Fund

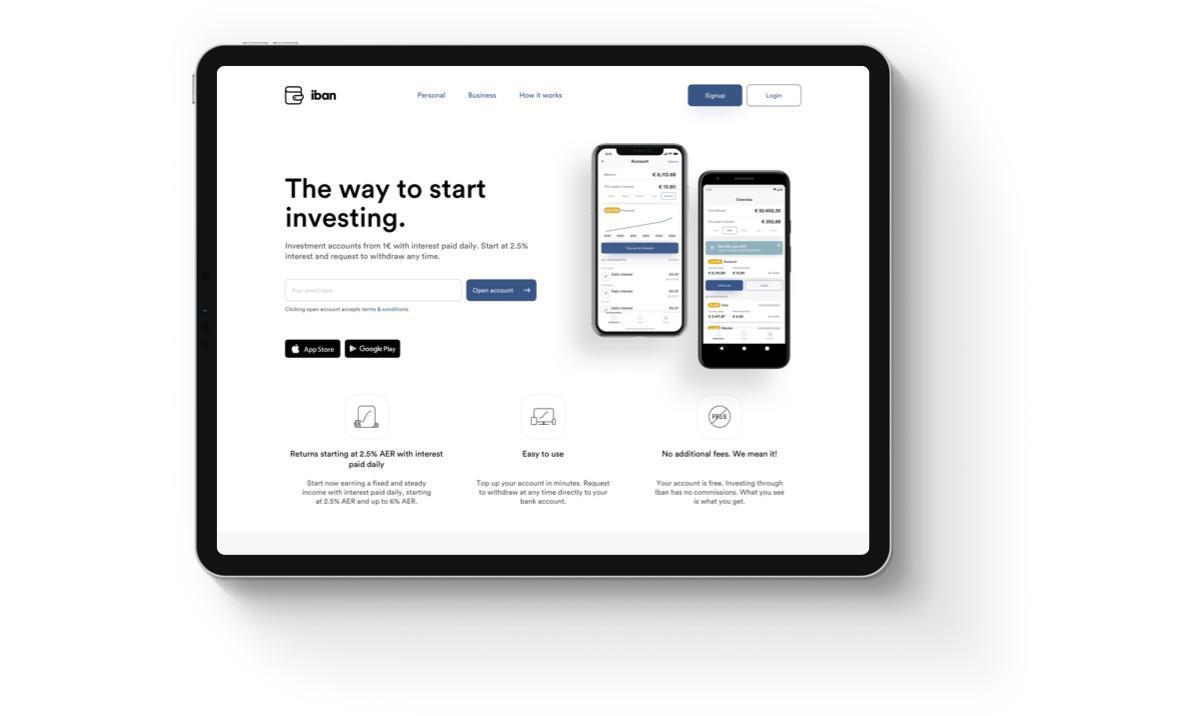

It is always necessary to have a fund as a backup when you have some debts to pay off. You can do this in a number of ways one example is investing in Iban Wallet. It is an app which allows the investors to earn interest on their deposits. The rates are projected at 2.5% and go up to 6%. This depends on the account the holder acquires. Customers can invest with just $1 and deposit as much as they like. This platform has no charges for withdrawal and other costs normally associated with such services.

As a result, with this account active, you can pay off your debts much easily without hurting your existing source of income. On the other hand, you need to make sure that you have invested for a few years to make the amount significant enough to clear off the debts.

Bottom-line

If you wish to foray into investing, iban Wallet is a good starting point to learn the ropes and test the waters. It might be worth your while.

So, what do you think ?