by Hope

There have been lots of writers here on BAD who have utilized a No Spend Month to make progress in their debt payoff journey. Here are just a few of them:

Parents Coming to Visit and No Spend Challenge

Doing it again – No Spend September

How the “No Spend Challenge” Can Help You Get out of Debt

Preparing for a No Spend Month

I have decided to try for 2 months of no spending. Of course, I had decided to try this and then my heat went out. But I do plan to move forward.

Prepared for No Spend

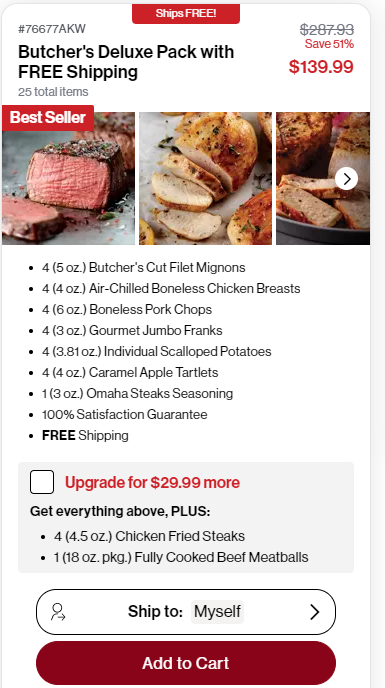

I prepared for this by reviewing my pantry to see if I have the food to last. (And my dad sent me a package from Omaha Steaks as a Christmas gift.)

Reviewed events and needs to make sure there was nothing out of the ordinary on the horizon.

And committed to NOT SPENDING for the next two months.

Setting Myself Up for Success

I believe that starting the year with this mindset accompanied by starting my new part time job are setting myself up for success on the financial front. Between my now 3 part time jobs + any additional project work I can pick up, I should be quite busy. Hopefully.

I am going to take a BAD commenter’s advice and do a weekly post about all spending which should be all bills. This will help hold me accountable.

One Setback

In addition to the heat debacle, I am facing, there has been one additional setback. The project I was to complete this over the new year holiday was put on hold…again! So the payment, a large payment I expected to receive around mid-month has been delayed again. (This has been a constant issue with this client/project that was originally contracted in August, 2023.) The timetable is once again up in the air. Which means, that the bills I anticipated covering easily for the next month-ish may be more challenging than I planned. However, there is another iron in the fire for more work that I am quite hopeful about. I will keep you posted.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

If you go to sites like good cheap eats you can find inspiration for a pantry challenge. I don’t know if you watch Tik tok but dollar tree dinners does a lot of content to stretch dollars and even has a little diabetic content.

3 jobs? I thought you only had two, and the second hadn’t started yet?

Hi Hope,

Is it possible to bill the client for part of the work as the timeline keeps dragging on? I’m sure you would have done that if it was possible. I’m sorry – it’s tough when things like that are out of your control. Ask A Manager has some advice on this topic: https://www.productdossier.com/blog/how-to-manage-a-client-that-causes-project-delay/

Good luck!

Whoops, the link I posted was not the correct one, nor was it helpful. Admin, feel free to delete these comments!

Spending less is great, but reviewing your $2500 “budget” post from a few weeks ago, it’s not clear how much impact this can really make in the near term. There is less than $300 discretionary spending in that budget ($100 Food, $80 gas, $100 health). You really need to generate more income quickly, especially given the furnace situation.

Hope, this same situation has played out so many times. You really need to not count money as income until it hits your account. The assumption of work/pay is just not a feasible way to budget when it has so many inconsistencies. You need to budget based on what is in your account, not what might be in there in a few weeks. I think this tweak in your budgeting alone will improve your cash flow planning.