by Hope

I wake up really, really early these days. My alarm is set for 5:30am, but I’m typically wide awake by 4:45am. A few days ago, it was even earlier. My mind just starts running…work stuff, plans for the day, plans for the month, etc. (I’m at the lake by 5:45/6am to walk my mileage every single day.)

Anyways, this particular morning, I got the urge to discard my savings plan for this month – travel and personal (not my Stash and Roth contributions). They are on automatic transfers, so the monies had already been moved to the respective savings account.

Now I know what you are thinking. OMG, what did she do this time?!

So here’s what I did…

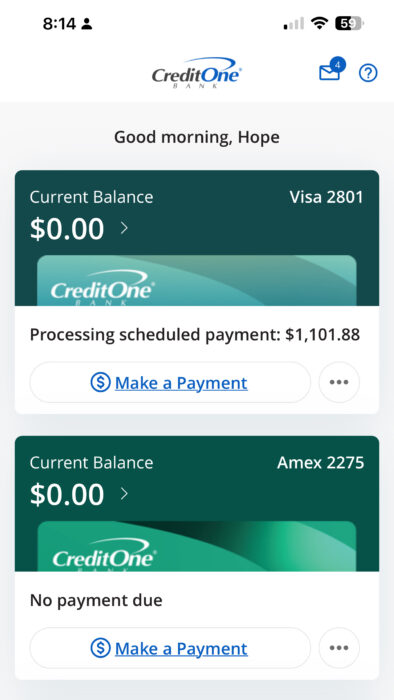

I impulsively paid off another credit card. So instead of $790 to personal savings + $500 to travel savings, I ended up with $188 to travel savings and $1,101.88 to debt.

Wise move or too impulsive?

Accounts Closed

The other account you see listed in this screenshot is the CC I paid off back in February when I first got this job. It’s remained a $0 balance since.

And now that they are both paid off…I am making the call to close both accounts as soon as the payment is done being processed! Woot, woot!

What’s Next

This puts my Amazon CC at the top of the list to get paid off next. But then I got to thinking that my largest balance is my Frontier CC (outside of USAA) and thus it costs me the most every month in interest. So what do you think? Should I pay off my Amazon CC in September? I believe I can pay it in full next month. Or should I focus on the larger balance Frontier CC which would take at least two and possibly three months to pay in full?

I wish I could add a poll to this post. Because whatever the votes tally in the comments, that’s the direction I’m going. So tell me, which CC should I focus on next?

Sidenote: The reason I am focusing on these instead of my USAA CC is that I intend to close out all these accounts as they are paid off. My USAA CC, the longest standing CC will not be closed. I am also leaving my Sam’s Club and Apple CC open. But all other credit accounts will be closed.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

This is exactly what I meant when I said you could be out of debt if you wanted to be.

Pay off Amazon in full the second you have the cash available. Make multiple payments this month if you can to save some interest. No question. Knock ‘em out, close the accounts and be proud of yourself.

Well, yes, but having steady and decent income makes a big difference in that. And I have been without that for two years now.

But now…all in!

Noted on the Amazon vote, that’s the way I’m leaning too.

woohoo! awesome job! I would pay off the Amazon card next just to keep this awesome momentum you have going and get the emotional boost you probably need to stay motivated and back on track. Then you can snowball the money you would have used toward these other credit cards and pay the higher one off faster. Great work!

Thank you. Good call on the emotional boost because I am definitely feeling proud right now.

Good job, and I agree!

Do not close out the accounts! Doing that will lower your credit score because you’ll have less available credit. You need to improve your score so you can get better auto and homeowner’s insurance rates. Freeze the accounts and delete them from everywhere online to take away temptation, but DO NOT CLOSE THEM right now.

Too late, already closed! And I’ll take the hit to my credit score. I knew it would come.

But I think it will bounce back with the increase in age of credit as these cards were only two years old.

It might be a little hit to your credit but I think that was smart. Now you can’t be tempted to use it again. Great job!

My thoughts exactly. And thank you.

Nah, for many people, it makes more sense to close the account. If you have a history of spending emotionally or justifying expenses that really aren’t needed in the heat of the moment, it makes no sense to keep them open. And my credit dip was so short, I was back in the 800s in months.

I think this was a wise decision for Hope.

Get rid of the Amazon next. You can roll the payments you would have made to it into the Frontier card and pay it off faster. I am hoping your next debt update has lots of zeros( and includes your house because your house is an investment but it is also debt you owe.)

I am not mad at it tbh. But I hope you don’t go into more debt to pay for the tickets for the Thanksgiving trip! I am glad you got more cards closed off.

No tickets for Thanksgiving. The girls and I are driving. So hopefully cost will be minimal.

History Buff already has his airline ticket (my dad uses points when we can do it in advance.) And Sea Cadet is not sure whether he will be off Thanksgiving or Christmas yet.

The travel funds is really for the last minute travel that will be required when my mom passes. I just don’t want to have to worry or have the kids worry about their ability to be there for that. It will be a stressful enough time.

NO MORE DEBT!

this is so awesome, I’m glad for you!! the Amazon CC is getting taken down next! ?? very happy for you.

Thank you. It definitely looks that way. Will see how the votes tally, but I think everyone has said Amazon card next.

These are the definition of smart moves. You are paying loads more in interest on the Credit Cards than you will ever make on savings. You do need to build up an emergency fund (and again, you need to set a specific goal for this), but paying down your debt needs to be your goal while you have this income coming in.