by Hope

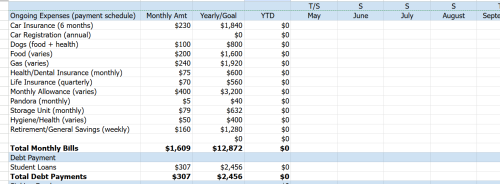

I appreciate all the feedback on my post sale budget. I’ve revised it to add more categories.

This covers the time period of May 15-the end of 2025 (eight months). And I thought that tracking whether it was a travel month, stationary month, or mix would make sense when I look back on this as that factor alone will greatly affect some of the categorial spending.

What categories have I missed? I want to get this nailed down before the sale closes so I have a clear plan on how to proceed.

Notes:

- I saw several recommendations for revisiting life insurance. I’ve added it to my to do list once I arrive in Texas mid to late May.

- I’ll have to transfer my car insurance and registration no later than the end of the year, I don’t know how much that will run in Texas so leaving insurance as it is now, and will revisit car registration when it comes time. My current tag expires in December so I have a little while.

- Obviously the gas, food, allowance categories will fluctuate based on it being a travel or stationary month. When I’m stationary, they will just build up.

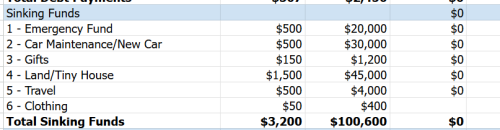

Sinking Funds

I need to have savings goals. But I did move them to sinking funds and gave myself either a long term goal or monthly goal. And I will track by month how much I contribute to each category.

I put them in order and set a monthly goal. My thought is this:

When I hit the monthly goal for that category, I will start on the next priority item for that month. For example, let’s say I make enough to contribute $500 to my EF in June, I would then start on the $500 toward the monthly car maintenance goal and so forth. And I start over at number 1 each month UNTIL, I hit the annual/overall goal. So when I get $20K in a EF, then every month I would start on number 2… and so forth.

Does that make sense?

Income

I know you want to see my income. But it fluctuates greatly. With this budget, I have to bring in roughly $2K per month after taxes and overhead to maintain, any more than that goes to the sinking funds. I think that’s easily achievable.

Some months I barely make $2K, but then with one project that jumps up to $8K. So I can’t really predict my monthly income. But I can tell you that I am laser focused on not only day to day work, but I’m working on two different passive income strategies and have been for 6 months now. Work in progress.

I’m also planning to search for a part time, in person job in Texas just to get me out of the house a bit. Maybe 1-2 evenings a week when a sibling can cover my parents. Probably more of a mental health thing, but will provide some income.

What do I need to clarify? What have I missed? (Before you ask, debt numbers are just around the corner.)

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

Is this post sale budget assuming ALL consumer debt is paid off with the proceeds of the house sale? I question $150/month for gifts and $1500/month for tiny home if you still have debt, even that $1500/month towards your student loans would be amazing. Looking forward to seeing true debt numbers, as it’s hard to comment on a budget without the full details.

Yes. Debt numbers publishing tomorrow.

But after house sale, the only debt that will remain are the student loans.