by Hope

I wake up really, really early these days. My alarm is set for 5:30am, but I’m typically wide awake by 4:45am. A few days ago, it was even earlier. My mind just starts running…work stuff, plans for the day, plans for the month, etc. (I’m at the lake by 5:45/6am to walk my mileage every single day.)

Anyways, this particular morning, I got the urge to discard my savings plan for this month – travel and personal (not my Stash and Roth contributions). They are on automatic transfers, so the monies had already been moved to the respective savings account.

Now I know what you are thinking. OMG, what did she do this time?!

So here’s what I did…

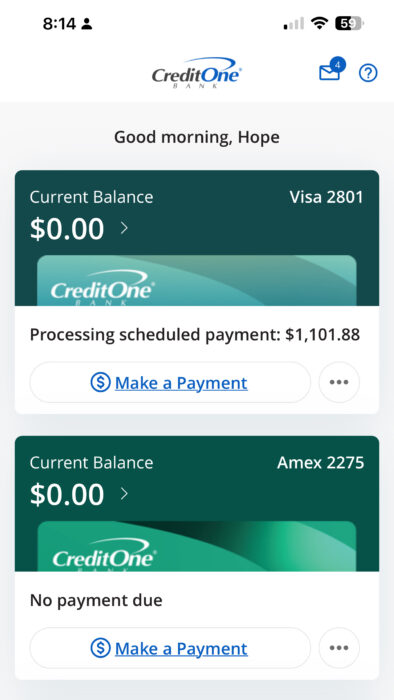

I impulsively paid off another credit card. So instead of $790 to personal savings + $500 to travel savings, I ended up with $188 to travel savings and $1,101.88 to debt.

Wise move or too impulsive?

Accounts Closed

The other account you see listed in this screenshot is the CC I paid off back in February when I first got this job. It’s remained a $0 balance since.

And now that they are both paid off…I am making the call to close both accounts as soon as the payment is done being processed! Woot, woot!

What’s Next

This puts my Amazon CC at the top of the list to get paid off next. But then I got to thinking that my largest balance is my Frontier CC (outside of USAA) and thus it costs me the most every month in interest. So what do you think? Should I pay off my Amazon CC in September? I believe I can pay it in full next month. Or should I focus on the larger balance Frontier CC which would take at least two and possibly three months to pay in full?

I wish I could add a poll to this post. Because whatever the votes tally in the comments, that’s the direction I’m going. So tell me, which CC should I focus on next?

Sidenote: The reason I am focusing on these instead of my USAA CC is that I intend to close out all these accounts as they are paid off. My USAA CC, the longest standing CC will not be closed. I am also leaving my Sam’s Club and Apple CC open. But all other credit accounts will be closed.

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 3 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.