by Hope

We have now made it past the second contingency period. The inspection has been reviewed and accepted. The appraisal is done. The closing date is just a couple of weeks away. I’m sure you all know that I’ve been playing with the numbers for months now.

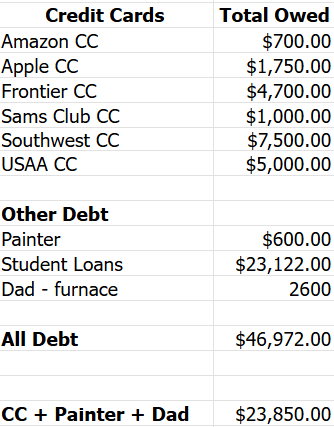

But I still don’t know how much I’ll actually take away from the house sale. However, I’ve got a solid plan for where the money will go. Obviously, the house will be paid off. The total for that pay out will be around $127,000.

First, the painter will be paid the remaining $600 I owe him.

Second, I will repay my dad for the loan from January, 2024 for the new furnace.

Third, I will pay off ALL of my credit cards. All except three of them will be closed. Eliminating the temptation. I will be leaving my Apple CC, Sam’s Club CC, and USAA CC open. They are already locked (and maxed out so the lock doesn’t really do anything.)

Between, these three items, $23.850 will be spent.

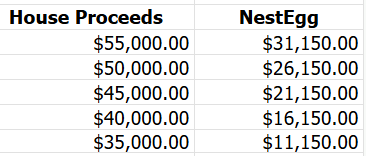

Based on my guestimates, that will then leave me with a nest egg of…

I do not plan to rush to pay off my student loans. At this point, they will be my only debt, and I’m comfortable with just starting to make regular monthly payments.

I have several other things I’d like to do, but I think the best thing would be to:

- Put at least $7500 in an EF. That would be essentially 3 months of living expenses should something happen to me/my work.

- Pay my car insurance through this 6 month period. My auto insurance is my highest monthly bill. And while there is no interest to make monthly payments, I’d like it to be paid. Then I can “pay myself” monthly so when it renews in September, I can pay it all at once. This is just a peace of mind thing vs a financial thing.

- The remainder will be used to jumpstart my Move fund in a high yield savings account.

I’m certainly open to feedback.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.