by Hope

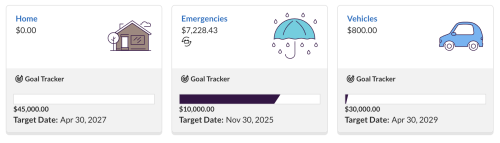

This is the month I will hit $10,000 in my emergency fund! The work was completed last month. I’m just waiting for payment to come in.

I am so excited!

Wedding Coming Soon

And in just over 3 weeks, I will leave to return to Georgia for a few weeks. The wedding is right around the corner. I am driving and taking Addie. She will be boarded the week of the wedding as part of my barter with the dog kennel. And my dad has graciously agreed to keep Cali (my older dog.)

All the kids have booked their travel for the wedding weekend. And a couple of my siblings and their significant others as well. Some of my immediate family will stay in Texas to care for my mom. But it’s going to be a wonderful time. And I’m so thrilled for Beauty and Redhead.

September Goals

With that being said, here are my goals for this month:

- Hit that $10K in my Ally savings! That will happen closer to the end of the month as I typically receive payment for my largest client around the 20th-25th.

- Test out my new “lower end” hearing aids to confirm they will serve for the next 3-4 years while I’m still in the return window. Also, hear what the ENT specialist has to say. The audiologist is under the impression that I might need surgery.

- DO NOT blow my budgeted travel expenses with this extended trip to Georgia. Housing is covered. Gas costs should be pretty nominal. Food is the variable that I need to plan for, but I’ve not really touched my grocery budget at all so I have some built up monies there. (I’ve got a budget for this trip. Will share that when I post my revised budget.)

- Purchase a dress for the wedding. Ugh! Thankfully, also haven’t touched my clothing budget too much so have some money put away for that. But hate the thought of a dress. Thankful that I can go barefoot for the wedding so no shoes required!

This Georgia trip will be my last travel for the foreseeable future. In fact, I have NO FUTURE travel planned at all. That might be a first.

But my parents need me here. The kids are all coming for the holidays. And I recognize that I need to really buckle down to meet my financial goals.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.