by Hope

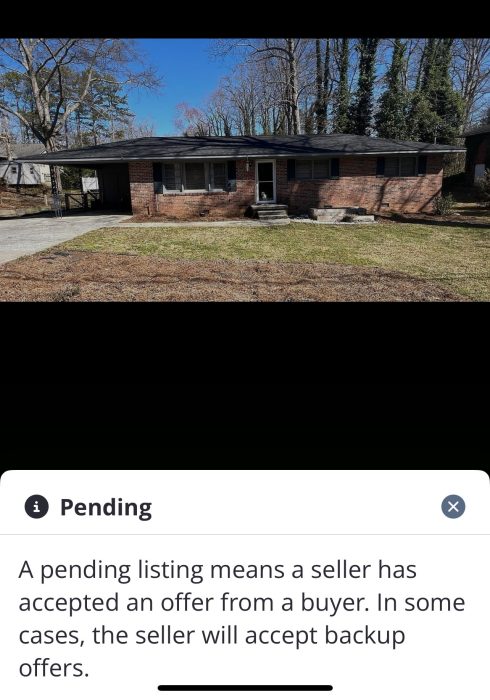

On the evening of Monday, February 24, the house went under contract. Anticipated closing is the end of March. I’m not going to share more until we get through appraisal and inspection.

This has altered my plans again.

- There is a buyer’s agent involved, but no seller’s agent. Because this all happened prior to March 1 when I was going to pass the house off to an agent, it is going through as FSBO. The lawyer who has always handled my family’s affairs here is handling the sale. (And yes, I do have to pay him.) I am also paying the buyer’s agent 3% which I advertised when I created the listing on both Facebook and Zillow.

- Instead of spending a month in Texas, I will be staying two weeks, then returning to Georgia pending the closing date.

Post House Sale Plans

If all goes well and as planned, the house will close by the end of March. That leaves me at loose ends the month of April. The family is all planning to be in Georgia for the first week of May for Princess’ college graduation, a family weekend, Princess’ 21st birthday, and Mother’s Day. And by family I mean all 5 of my kids plus some of my immediate family from Texas.

Options

I won’t make any firm decisions or plans until I know the house will close as scheduled. But I am reviewing options so I am ready.

- Beauty and her fiancé have a home with a guest room that they have invited me to stay for a while.

- Princess has an apartment (couch) where I could stay for a few days, probably week max. I will most likely stay here the week directly after closing since we have appointments together that week.

- Return to Texas for the month.

- Roadtrip!

Exciting things ahead!

Update

Buyer pulled out March 4th via email from their real estate agent. The due diligence period was through March 7th. No reason was given. (I believe it had to do with their financing as they were getting a 100% finance loan.)

It definitely through me for a loop mentally. After giving myself a couple of days to process. I’ve decided to return to GA at the end of this two week period, and decide what to do then. I need a break from thinking about the house. So it will sent empty. And I will focus on work and finding more work. And spending some quality time with my family.