by Hope

As of today, I now need to make $3,555 this month to pay the bills. It’s doable. I’ve got the work lined up.

I realize this gives many of the BAD community heartburn. I suppose it does me as well. But I am used to it.

With the work lined up to cover this month’s bills. These are my other financial goals for this month…

No or Little Discretionary Spending

As of today, I will spend the entirety of this month in Texas. I have budgeted $250 for food, gas, and dog expenses. (This is included in the total mentioned above.) It’s what I would have budgeted if I were at home. My goal is to spend as little of this as possible. Whatever is not spent, will go to a debt payment at the end of the month OR be put to next month’s bills should I not have work lined up by the end of the month.

Most if not all of my time in Texas will be spent with family. My sister wants us to go camping, car camping for me. I’m pretty sure she knows free places to camp. And my baby brother is having a house warming at his new place, so I’ll buy him a plant or something. But otherwise, I’ll be with my mom and dad. I don’t anticipate the need to spend much money. (I’ve explained before that my dad buys all the food while I’m here, and I do the cooking.)

Increase Income

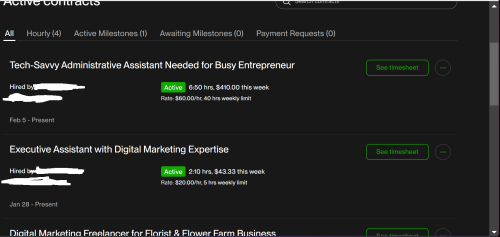

I was able to capture the four ongoing contracts that I am working on with a very focused week of job seeking, rather contract seeking. I’m working approximately 20ish hours per week. It does fluctuate based on what each client needs. I’d like to double my contracts by the end of the month with an increase in hourly rate. (My current contracts range from $20-$60 per hour with the site taking 10% as a contract fee.)

Because I was starting over after almost 4 years off my normal platforms, I took on some lower budget clients to get started. Any work increases your stats on the platform. This has paid off in getting me ranked again which puts me in front of more clients. Now I need to be more discretionary with the project budgets I accept.

Am I explaining that well?

I plan to spend several hours each week focused solely on submitting proposals and following up on project leads. The goal is to increase my monthly income from around $6K to $12K.

Looking into the Past

Because of my illness for most of the first two months of this year, I failed to properly re-launch my consulting business. My goal is to complete the work on not 1, not 2, but 3 of my personal websites plus a variety of landing pages to do a proper re-launch including social campaigns, some small ad campaigns, and a very targeted email campaign to past clients.

Thankfully this is going to be enhanced, I think, by having completed a good handful of new client websites in the last 3 months. I’ll have a solid, recent portfolio to showcase along with new client testimonials. (At least, that is the goal. I actually have to finish a couple of the sites still, but they are on track.) If I have to use old portfolio sites, I will, but would rather use the new ones.

Looking Forward

I don’t know what comes after this month. So there’s no planning or prepping – a very weird place for me to be. It’s just a heads down month trying to tread water and dig out. No distractions.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.