by Hope

I received a lot of great feedback on my longer term savings plan a month or so ago. Specifically about how having all my “buckets” on my Ally account may make me more susceptible to dipping into these funds. And that made complete sense to me.

So I’ve reallocated my Ally account to be my long term savings account only. And left 3 buckets there. (I didn’t remove any money, just moved everything I had been putting in the various buckets to the Emergency bucket.)

Savings Plan

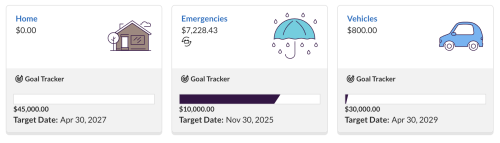

Here’s my buckets on this account, goals and hoped for timelines:

Goal #1: $10K in my emergency fund. I should hit this next month or October latest.

Goal #2: $45K by April, 2027 toward a home. Or rather toward land for my next home. My dream is to build a small home, cash flow it. And by build, I mean with my own two hands plus some help from family, kids, etc. My sister has the same plan. But this initial money will be used to buy the land in cash, paid in full. No debt.

Goal #3: $30K by April, 2029 toward a new car. I don’t see any reason my car should need to be replaced before than barring anything catastrophic. This is in preparation for paying cash for my next car.

Sinking Funds Where?

I have a bunch of other savings categories in my budget. Now I have to figure out the best vehicle for those. Suggestions? (And yes, I am working on a revised budget now, will share for feedback in the next week or so.)

The commenters were spot on in making the recommendation for me to split these longer term savings buckets from those that I will need to dip into more often. But there do I keep my other buckets? I would love your thoughts on that.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.