by Hope

I realize the many posts on the house and the delay in things happening and posts going live has caused a bit of confusion. This is a synopsis post of what has happened to date and where things stand as of today.

Late January/Early February

I requested referrals for real estate agents on Facebook. I interviewed 5 by phone and had 2 of those 5 come to the house. Both of them showed up with printed comps based on our phone conversation. I was very transparent about my plan to list FSBO, but then pass off to an agent when I left town.

February 10th

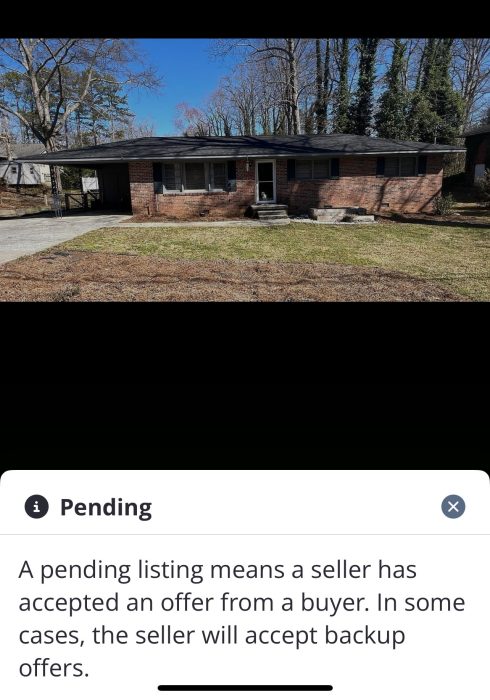

House went on the market FSBO. I listed it on Facebook Marketplace and Zillow. (No cost for either.) And everyone (local to me) I knew was gracious enough to repost it on their Facebook pages. It was listed for $210,000. (The housing market where I live is pretty hot especially for homes that could be rentals. Investors are buying them up quickly.)

February 12-18

Local buyer who moved here last April from Turkey viewed the house and gave me a verbal offer (no agent) for $205,000. He had a pre-approval and planned to put $70,000 down. He backed out on 2/17 or 2/18 via a text message because his son wanted to live “close to markets.” (I found that funny seeing as this is a tiny town, there is definitely nothing I would consider a market.)

February 20-March 3

- Had an agent showing on 2/20 evening. They came again on 2/23 and sent a written offer that evening. There were required to provide proof of preapproval for this offer as well.

- On 2/24, I countered and they accepted. Written contract with buyer agent. Closing date was to be 3/24.

- On 2/28, I left town with house under contract. I had not signed with an agent.

- On 3/3, inspection happened and buyer pulled out. No reason given.

March 4-6

First thing I did was update my Zillow listing with some of the new images. And change the listing price to $207,000.

I contacted a different agent on March 4. Before you jump down my throat, the agent I had originally selected gave me an attitude when the house went under contract. (I was very open about my plan.) And it really took me back, some of things she said. Not only that, during this “rant” via phone, some of the things she stated had me second guessing using her. She’s a nice person, but I don’t believe I would get the best offer I can get using her.

So different agent. He went and looked at the property on Thursday (3/6) after I laid all the cards on the table about the challenges and what i was looking to get. He highlighted some red flags. But didn’t immediately dismiss my “bottom line” as unattainable.

I’m waiting for him to get back to me.

On March 5, two other agents reached out to me about showing the house on Saturday. I called them on March 6th, and we set it up after I gave her all the details…culvert and water issue, etc. Their buyers are pre-approved, getting a FHA loans, and will need help with closing costs. They both shared the challenges with the house with their buyers and they still wants to see it.

March 8

Today, Beauty will go and open up the house for the showing this afternoon. We shall see.

Sidenote: My entire property is covered by security cameras that notify me of movement and record 20-30 of movement with each notification. On March 7, two women showed up and walked the property. I am assuming it’s one of the potential buyer’s as they were pretty bold in looking in windows and never knocked on the door.

Conclusion

That is a synopsis of the house selling situation to date. I am still planning to stay in Texas for this next week and then return home and figure out next steps. It may be a short stay. But I will be in Georgia for at least a couple of weeks. I have doctors appointments, vet appointment, and Beauty’s wedding dress shopping scheduled for the end of the month.

These were all scheduled with the the March 24 closing date in mind. But now I will have some flexibility on whether I stay or go in April. Just learning to relax and trust the process.

The house isn’t sold until it’s sold. And it may not sale. And I will cross that bridge when I come to it.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.